5 Reasons Your Nonprofit Needs an Operating Reserve

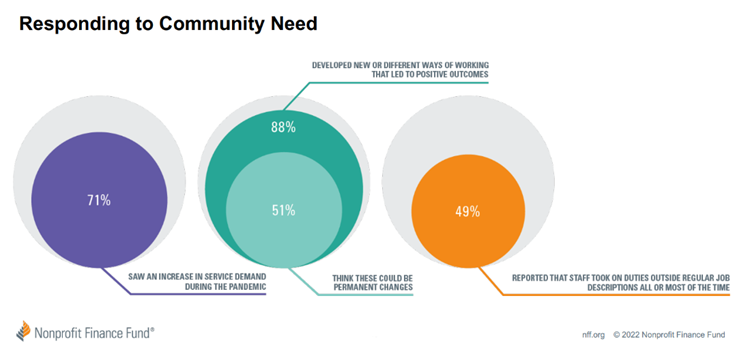

There has long been a popular misconception in the philanthropic sector—if a nonprofit has money, it must not need money. And yet, in the 2022 State of the Nonprofit Sector Survey, the Nonprofit Finance Fund found that 71 percent of respondents said that the need for their services increased during the pandemic. Did any of those organizations begin fundraising in January 2020 because they knew more people would need their help in the next few months? Probably not.

“Not-for-profit” does not mean “no surpluses allowed.” An operating reserve can help ensure that an organization can continue its vital programming activities even during uncertain economic conditions. As the saying goes: It’s a tax status, not a business model. Fortunately, many nonprofit donors and charity rating groups are moving away from this way of thinking and are now acknowledging that operating reserves play a vital role in building an organization’s long-term sustainability.

What Are Nonprofit Operating Reserves?

A nonprofit’s net assets are divided into two categories: with donor restrictions and without donor restrictions. Unrestricted funds can be used for anything the organization needs, from starting a new program to buying copy paper. Restricted funds can only be used for the specific purpose or time the donor intended and are typically tied to an individual program, project, fiscal year, or permanent endowment. An Operating Reserve Fund is a discrete component of net assets without donor restrictions that is set aside by an organization’s Board for availability when cash flow is tight, or funds are required for unforeseen operational needs. The Operating Reserve is designed to be built up to a target amount, and the funds must be replenished per the policy established by the board.

5 Reasons for Building Operating Reserves:

Nonprofit operating reserves are valuable during times of uncertainty, as we’ve all learned in the past few years. But even when the economy is strong and community needs are steady, it never hurts to have a financial cushion. Here are five reasons why your nonprofit organization needs to build an operating reserve:

- Support the fulfillment of your mission. Operating reserves provide an internal financial safety net when day-to-day operating cash flow is low, unreliable, or if reimbursable grant payments are coming late. It helps organizations avoid a fragile state, which can compromise program quality or quantity.

- Provide financial flexibility and foster strategic decisions. Reserves do more than allow you to react to fiscal emergencies. If you have reserves and enough positive cash flow, you can make sensible choices like making bulk purchases to take advantage of better prices. They also position you to seize opportunities that you may not have been able to take advantage of otherwise.

- Reduce stress through improved cash management. Many nonprofit staff members experience burnout as a result of consistent cash flow stress, which often leads to low morale and increased staff turnover. Losing and replacing dedicated staff members is an expensive and exhausting process.

- Demonstrate proactive, prudent management and planning. It’s hard to think ahead and make sure the organization is sustainable when you’re living hand-to-mouth. The presence of a Board-designated operating reserve indicates the organization’s explicit intention to deliver on its promise for the long term.

- Promote donor confidence. As I mentioned earlier, many funders were once of the mindset that an organization with money is not in need of additional funding. This thought has led nonprofits to shy away from building up their cash because it might weaken their position in grant applications. However, it became evident after the market crash in 2008 that many under-capitalized organizations were so financially fragile that they didn’t make it through. More recently, especially after the unexpected challenges of a global pandemic, inflation, and possible recession, many more funders are looking to invest in financially stable organizations that are thinking ahead and appropriately managing their funds.

Communicating with Stakeholders about Operating Reserves

Your donors, staff, and Board members may not understand operating reserves right away. That’s why it’s important to communicate using both numbers and narrative. On internal reports, make sure to include information about your reserves. Display each reserve as a separate line item on the balance sheet in the net asset section. If it were accessed, it should show as due to and from the reserve in the liabilities section. I always advocate for providing narrative notes to explain clearly what’s going on in those sections of the report.

In audit or external reports, you can choose to show the operating reserve balance separately in the net asset section of the balance sheet or Statement of Financial Position page. You can also provide narrative and a breakdown of that section of net assets in the notes section—another opportunity to explain the intention behind creating reserves – as well as in Section O of your IRS Form 990.

If you want to learn more about building and maintaining your nonprofit operating reserves, watch our webinar, Reserving for Sustainability: Making a Case for Building Nonprofit Operating Reserves.

Fund Accounting Software that Drives Impact

Find out how Blackbaud’s Financial Edge NXT® fits your organization.

This post was originally published September 2016 and updated September 2022.