Modernizing the Payables Workflow: A Smarter Approach for Nonprofits

Your payables processes are the gears that make your organization move. Vendors get paid, so your programs keep serving. Expenses get categorized, so you can plan your budgets, cash flow, and impact reporting. But with a paper-driven or manual process, those gears can’t turn quickly, potentially leading to projects going overbudget or not adhering to funder restrictions.

By modernizing your payables workflow with automation and AI-powered functionality, you improve efficiency and empower your team to be more strategic. Better, more streamlined payables processes help your organization to move faster, spend smarter, and drive more impact.

Why Nonprofits Need a Modern Payables Workflow

No finance team wants to feel the dread of realizing an invoice was paid from the wrong grant. Or the urgent call from a program manager that wants to confirm a vendor has been paid so they can continue services, only to realize the information is buried in spreadsheets and email threads.

Your account payable processes must account for all your funding sources, from unrestricted donor funds to restricted major gifts to compliance-driven government grants. Without a modern payables workflow, you are often juggling deadlines, account codes, and audit trails in your head, instead of in your system.

A modern, automated payables process means you and your team have real-time access to financial data, and your leaders can make faster, smarter decisions. With current information on what’s been paid and what’s upcoming, you can respond quickly to changing conditions and allocate resources where they’re needed most. It also helps safeguard your organization by detecting anomalies early and preventing accidental miscategorizations of expenses, thanks to automated alerts and clear audit trails.

For lean finance teams, having centralized documentation and streamlined processes means less time spent chasing information and more time focusing on analyzing the data. Automated workflows also strengthen your internal controls because they can enforce separation of duties and reduce the risk of errors or misuse of funds. And by minimizing manual data entry, nonprofits can improve data accuracy, ensuring cleaner, more reliable financial information across the board.

What a Modern Payables Workflow Looks Like

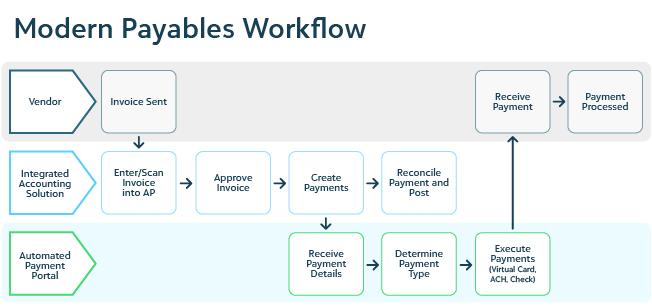

Modern workflows are designed to bring together automation, intelligence, and control, making everyday financial tasks smoother and more reliable. For example, smart invoice scanning tools, or Document Intelligence, can automatically extract and categorize data from invoices and receipts, saving time and reducing errors. Once expenses are captured, they’re routed to the correct accounts without anyone needing to manually intervene, which keeps things moving quickly and accurately.

Budget checking happens in real time, so teams stay informed and on track, with built-in safeguards to prevent overspending. You can also streamline approvals, with automated rules triggering reviews based on predefined criteria, so you avoid bottlenecks and delays. And when it’s time to pay, automated systems handle scheduling and execution securely, with internal reviews and compliance checks built right in. Plus, all payment information is tracked and easy to access for anyone who needs to review it.

How Fund Accounting Software Supports a Modern Payables Workflow

Fund accounting software designed specifically for nonprofits—like Blackbaud Financial Edge NXT®—offers powerful tools that make financial management smoother and more intuitive. With AI-enabled automation, tasks like invoice capture and payment processing are handled quickly and accurately, freeing up your team to focus more on your mission and less on manual work.

Robust permissions ensure that everyone on your team has access to what they need based on their role, which adds both flexibility and security. Predefined distributions and categories also make things easier for nonfinance users, so instead of selecting complex account strings, they can simply choose options like “travel” or “meals” when submitting expenses.

Getting Started with Blackbaud Financial Edge NXT®

Think of Financial Edge NXT as the foundation for your journey to enhance your payables flow and accelerate impact. With Expense Management, non-financial staff can submit and track expenses from any device. They can take advantage of pre-set expense categories like “Mileage” or “Supplies” to fill in the required complex distributions. Approval processes are streamlined, with pre-set approval rules that make internal controls easy to follow.

And, with native Document Intelligence, submitters can upload invoices for scanning straight into Expense Management, with AI-powered functionality working to pull and fill out the correct information to submit an invoice. Once the invoice is ready and submitted, it will follow the pre-set approval flow within Expense Management, ensuring the proper eyes are able to review and approve before the invoice is officially generated in Payables.

Once in Payables, your Accounts Payable team can take full advantage of Payment Assistant™, our native automated payments functionality. Payment Assistant allows you to group payments into runs with custom approval tiers and flexible delivery options in virtual cards, paper checks, or ACH. It even handles vendor remittance automatically, saving you and your team time, effort, and money.

Learn more about how your organization can embrace a modern payables workflow with Payment Assistant in Financial Edge NXT.