How to Overcome Common Challenges in Your Nonprofit Budget Approval Process

Navigating the budget approval process in nonprofit organizations can sometimes feel like a maze full of frustrating dead ends. You know your budget is the map to reach your organization’s goals, but the labyrinth-like challenges—like endless review cycles and unclear decision-making authority—can derail financial plans and slow down mission-driven activities.

To streamline this crucial process, it’s essential to identify common blockages, improve communication across departments, and simplify workflows. By addressing these pain points in the nonprofit budget approval process, you can ensure that financial decisions are made quickly, transparently, and in alignment with organizational goals.

The Pain of a Convoluted Nonprofit Budget Approval Process

Have you ever felt the frustration of navigating an unnecessarily complex or poorly understood budget approval system? Who approves what? Why did someone change the budget when everyone thought it was finalized?

These common issues can create significant bottlenecks and inefficiencies for your organization.

- Multiple Approvers: Having too many people involved in the approval process can lead to confusion and delays. It’s often unclear who has the final say, and decisions can get stuck in a loop of endless reviews.

- Lack of Transparency: Changes to the budget can happen without proper communication, leaving team members in the dark. This lack of transparency can lead to frustration and mistrust among staff.

- Inconsistent Updates: When updates to the budget are not consistently communicated and documented, your team may inadvertently use outdated information for decision-making. Resulting errors can create a misalignment in your long-term and short-term financial planning.

- Manual Processes: Relying on manual processes for budget approval can be time-consuming and prone to errors. It can also lead to burnout among finance professionals who are constantly chasing approvals and updates instead of working on strategic projects.

By simplifying and streamlining the budget approval process, you can ensure that your final budget is aligned with your goals, reduce the risk of overspending, and improve overall financial management.

Common Issues to Avoid in Your Budget Approval Process

Here are six common mistakes nonprofits make when designing and implementing their budget approval process.

- No Documented Budget Approval Process: When there isn’t documentation, people rely on outdated information or make up their own process. Conduct a thorough review of your current budget approval process to identify and address common delays. How many times are people reviewing updates? Talk with people at various stages of the budget process to understand where the frustrations are. Your approval process should be documented as part of your larger budget process documentation.

- Inconsistent (or Non-Existent) Communication: Start with a kick-off meeting so everyone involved understands the goals, timelines, and documented process for your budget creation. Being clear about approval expectations at the front can speed up the process. Set up regular check-ins and, if possible, use collaborative project management tools so everyone can see progress.

- Not Using Technology: So many nonprofit financial teams rely on spreadsheets for their budgeting process. It’s a good place to start, but it’s difficult to understand what’s final and what’s changed. Invest in a fund accounting system with budget management capabilities, such as automated workflows, real-time tracking, and centralized documentation management. The goal is to work smarter, not harder!

- Lack of Training for New Staff: Provide training for new staff and stakeholders on the budget approval process and tools. Get everyone started on the right foot and provide training for others who might need a refresher.

- Unclear Deadlines: Establish clear deadlines for each stage of the budget approval process. Use your project management tools to set reminders. Your project management tool can also make it clear what is hinging on a late approval—if the community garden program hasn’t finalized their part of the budget, the larger program team doesn’t know what they need, and the marketing team needs the program budget to understand how many appeals to plan on sending.

- Simply Checking the Box: Your process will need to adjust based on your team, your organizational priorities, and what’s happening in the larger world. Continuously monitor the budget approval process and gather feedback from staff and stakeholders on how to make it better going forward. Make sure staff aren’t just checking the box but are actively engaged and aware throughout the process.

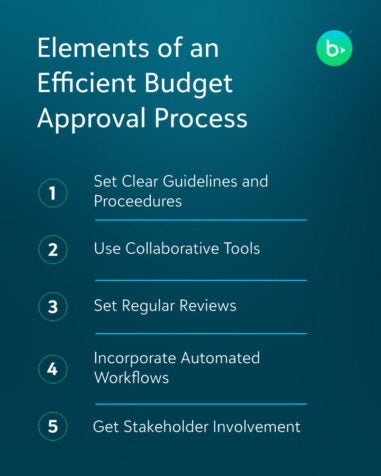

Key Elements of an Efficient Budget Approval Process

The budget approval process is the backbone of your nonprofit’s financial management, ensuring that every dollar is accounted for and aligned with your organization’s goals. The people who need a say in the budget have reviewed and signed off on the final document. When done right, your budget approval process sets clear financial boundaries, promotes transparency, and fosters accountability among team members.

Here are five ways to create an efficient budget approval process.

1. Set Clear Guidelines and Procedures

Establishing clear guidelines and procedures for budget approval helps streamline the process. This means documented expectations that team members can access and refer to throughout the budget process. These guidelines ensure that staff understand their roles and responsibilities. Provide training each year to review best practices, highlight common issues, and address functionality updates in your fund accounting system.

2. Use Collaborative Tools

Use collaborative tools and software to facilitate communication and document sharing among team members. This can help reduce delays and ensure everyone is on the same page. Spreadsheets are an inevitable part of a budgeting process, but use templates whenever possible and make sure you upload your finalized budget into your fund accounting system so everyone can see the result—and any changes after the budget has been finalized are clearly tracked.

3. Set Regular Reviews and Updates

Schedule regular reviews and updates to the budget to address any changes in financial circumstances or organizational priorities. This proactive approach helps your team make timely adjustments and avoid last-minute surprises.

4. Incorporate Automated Workflows

Implement automated workflows to handle routine tasks such as data entry, approvals, and notifications. Automation can significantly reduce the time and effort required for budget approval, so your team can focus on strategic activities. Understand what options you have within your fund accounting system to automate your budget and financial reporting processes.

5. Get Stakeholder Involvement

Make sure you involve key stakeholders at appropriate points in the budget approval process to ensure their input and buy-in. You don’t want to get to the final approval and have the board question the need for your new fund accounting system. This collaborative approach leads to more informed decisions and greater support for the final budget.

Build Confidence with a Streamlined Budget Approval Process

A streamlined budget approval process ensures greater transparency and accelerates decision-making. When financial decisions are made quickly and clearly, you allocated your resources efficiently, which supports your mission’s success. Everyone can see exactly where funds are directed and understand the reasoning behind financial choices. This open approach not only builds confidence but also encourages further support and engagement.

Ready for a system that simplifies your budgeting process? Check out the webinar, 10 Ways Blackbaud Makes Budgeting Easy.