Taking the Guesswork out of Managing Restrictions with a Fund Accounting Solution

You know how important it is to manage your funds according to their purpose and source. That includes ensuring that you use restricted donations, grants, and other revenues in accordance with your donors’ and funders’ wishes. Plus, you need to report on these financial activities to various stakeholders, such as the board of directors, the government, and the public.

Is your accounting system designed to handle these complexities? Or do you have to rely on manual workarounds, spreadsheets, and guesswork to track and report on your restricted funds?

If this mess of circumvention sounds familiar, you are not alone. Many nonprofit organizations struggle with managing restricted funds in an accounting system built for businesses, not nonprofits. A fund accounting system with sub-fund capabilities is the best solution for helping you overcome the challenges of managing restricted funds.

Understanding Fund Accounting

Fund accounting is an approach to financial accounting optimized for government and non-profit entities to track use of dollars by program area, and restriction of dollars received.

For US nonprofits, fund accounting is the preferred method of complying with the nonprofit financial reporting requirements in FASB Accounting Standards Code 958—even though use of fund accounting is not actually required in US GAAP. For any entity that needs to be able to track their financial activity based on not only how the funds are used but also what they are used for, fund accounting is ideal for being able to provide accountability to stakeholders and actionable analysis to decision makers.

Why Managing Restricted Funds is Different

Tracking restricted funds adds a fair bit of work to the management of those accounting transactions. Instead of everything rolling up into one net asset balance, independently balancing activity must be tracked for the restricted fund and the unrestricted fund. Typically, this means needing to keep track of not only which funds are restricted in the accounting software, but also managing how they’re restricted elsewhere.

While an organization reports their total restricted balance, those restrictions could be for different activities. Without fund accounting software, tracking at that level of detail must be done manually outside the system. For example, if the organization incurs an expense for a purpose covered by a restricted donation, the finance team needs to be able to identify what, if any, restricted fund balance exists, and then, in addition to recording the expense, also do a release from restrictions to cover that single expense. While this is possible with spreadsheets and shared files, those workarounds can create errors in your data, inconsistent application of controls, and a lot of time spent making sure the data is updated properly.

Avoid these headaches with fund accounting software that can track net asset balances across discrete records beyond just net asset classifications, and managing releases from restrictions can be as simple as a monthly closing adjustment based on saved reports.

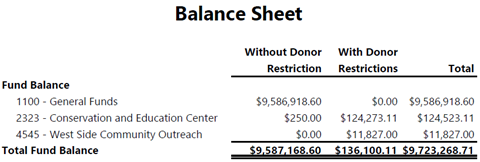

Here is an example of an organization with $136,100 of their $9,723,269 fund balance with donor restrictions. By using a fund accounting system with sub-fund capabilities, it’s also possible to quickly identify what the restricted funds are restricted for—all without any additional entries.

Communicating Restricted Fund Balances by Program

Knowing your restricted fund balance is crucial for day-to-day decision making. While many stakeholders value knowing how much of an organization’s net assets are restricted versus unrestricted, other stakeholders—like program directors—need to know what it is actually restricted for. For example, one program director wants to take advantage of an upcoming conference that wasn’t originally in the budget. Knowing that this program has a large balance of funds restricted to its use beyond what has been budgeted, versus knowing if this would be pulling directly from unrestricted organizational funds, can help decision makers determine whether such an undertaking is financially feasible for the organization.

Similarly, when a bill comes in for a particular program, does that expense trigger a release of restricted funds to cover the bill? With a fund accounting system, you can drill into the details instead of juggling different spreadsheets—that you hope were updated correctly—to know if you should do an entry to release those funds.

Ensuring Accurate Data for Decision Making

You don’t want to create a separate fund for each possible activity your organization engages in, but you still want to be able to break down that restricted balance by the purpose its restricted for. What’s a CFO to do?

A fund accounting solution with sub-fund capabilities can not only take the guesswork out of how to manage it all, but it can also ensure you’re always making decisions based on current, accurate balance information, without having to reconcile with external spreadsheets first.

First, you can always have an accurate picture of what portion of your net assets is restricted to which project. Fund accounting software that allows your programs to retain equity gives you an instant snapshot into which projects “own” what portion of the fund balance in reporting. Then, in one report, you can get an instant restricted net asset balance on the level of detail that is meaningful to you.

Traditionally, you’d need to juggle spreadsheets to figure out, for each expense transaction, if it would be covered by restricted funds. But with the sub-fund record capability of fund accounting software, you can code your activity with the level of detail needed to identify what areas of your mission it relates to, allowing you to run reports reviewing both summary activity and detail.

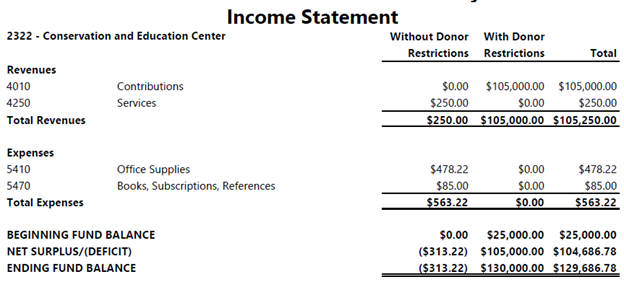

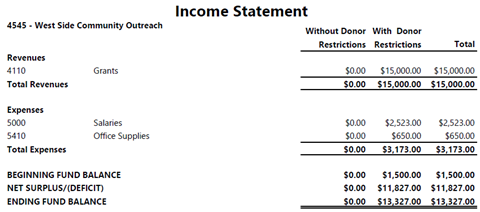

This income statement displays activity in one program area. Based on the With Donor Restrictions fund balance, we know the full amount of expenses can be covered by funds restricted to this purpose.

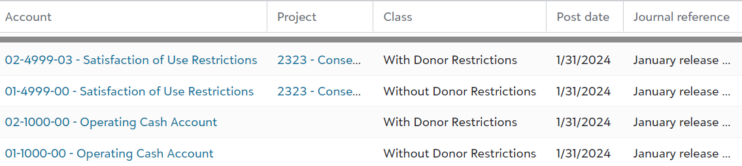

Then, you can do a bulk release of that net activity. Rather than having to manage reclasses for each expense as it comes in, instead, at the end of the week, month, quarter, or whatever time frame works for you, you can add a single journal entry batch to transfer net assets with donor restrictions. Adding attachments such as filtered Income Statements and General Ledger reports to these release entries in your fund accounting system will make providing back up a breeze.

Because this organization could quickly and easily report on expense activity and restricted balance for this program, a single journal entry was able to release restrictions for multiple expenses.

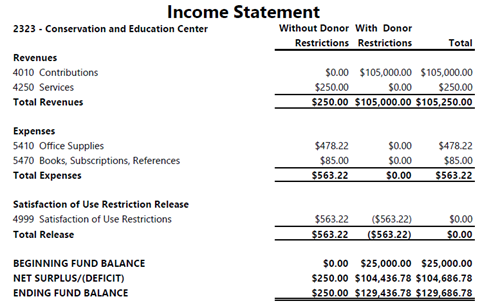

Another solution would be to avoid release entries when possible by allowing expense activity to be paid out of restricted funds directly. While that is not standard for fund accounting, with self-balancing software tracking net asset classification within funds, you can let your software maintain the balance for you. This is especially helpful when you know most of your transactions are covered by restricted funds, because it eliminates the need to monitor and reclass the restricted balance.

In this example, the organization verifies the availability of restricted funds to cover expenses prior to coding the expense transaction. When there are restricted funds available, the expense is coded directly to the restricted fund balance. The self-balancing nature of funds in the accounting system ensures proper net asset balancing.

Improving Efficiency—and Minimizing Headaches—with Fund Accounting Software

Fund accounting software can make a big difference for nonprofits that deal with restricted funds. By using sub-fund records and self-balancing funds, you can easily track and report on the activity and balance of each restricted fund, without having to rely on manual spreadsheets or complex journal entries. This way, you can save time, reduce errors, and ensure compliance with donor wishes and accounting standards. Whether you choose to release restrictions periodically or directly pay expenses from restricted funds, fund accounting software gives you the flexibility and control you need to manage your restricted funds effectively and efficiently.

If you are ready to switch from a mess of spreadsheets to an accounting system built for managing restricted funds, join us for a product tour of Blackbaud Financial Edge NXT.