The Status of Fundraising 2024: Global Research Highlights

Amid ongoing economic uncertainties and the global pandemic aftermath, nonprofits have had to navigate a lot of change in recent years—shaping the global nonprofit space towards digital-first experiences and processes. What’s more, modern innovations are making their way into the nonprofit sector, too, further changing the needs and expectations of prospects, donors, and stakeholders.

We conducted our annual Status of Fundraising research in Canada, the United Kingdom and Australia/New Zealand (ANZ). These regional research reports delve into the evolving dynamics of nonprofit fundraising in each region and give a comprehensive view of the social impact community in 2024, helping nonprofits understand and benchmark their performance.

In this article, we share a glimpse of what 1500+ participants globally told us about their recent performance, current fundraising strategies and opportunities, use of technology and CRMs, and attitudes and use of artificial intelligence (AI).

While these findings are not entirely comparable due to differences in the sample per region, they give excellent insights into the social impact sector and trends across the world.

Income

When asked to think about their performance in the last full financial year, most participants across regions shared that their income either increased or remained the same.

However, a big chunk of participants was unaware of their income changes—likely impacted by the increase in large nonprofits participating in the research. This is especially evident in Australia/New Zealand where 27% of participants didn’t know how their voluntary income changed, but where we also had a 72% increase in large nonprofits taking part in comparison to last year’s sample.

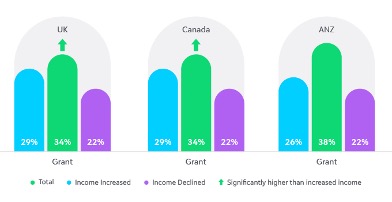

When focused on income streams, grants are ranked as the main income stream across all three regions. However, what’s also evident is that nonprofits who shared that their income decreased in the last full financial year are more reliant on grants. In turn, growing nonprofits have a more evenly spread income stream portfolio.

While these grant-related findings are similar globally, there are other differences when it comes to income sources. Legacies are a significantly more important income stream in the UK when compared to nonprofits in Australia/New Zealand or Canada.

Major donors, in contrast, are more important to nonprofits in Canada and Australia/New Zealand than in the UK, especially so in Canada.

Digital Maturity

A digitally mature nonprofit is one where digital is integrated across all areas, including fundraising, supporter experience, internal processes, and more. We asked participants to place their nonprofit on a digital maturity spectrum, ranging from 1 (lowest) to 10 (highest).

Individuals in Canada ranked their nonprofit as the most digitally mature:

The 2024 average score is lower in each region when compared to 2023 or 2022. While digital disruption has always impacted the sector, it’s likely that AI has had an influence on these results.

This was the first year that our Status of Fundraising research focused on AI, likely impacting how nonprofit organisations rate their current digital maturity. Only a few are prioritising and truly embracing AI—as we will explore later on in this article.

Digital Maturity and Performance

Interestingly, the research also shows a link between digital maturity and income increase, and these findings are evident globally.

In the UK, those with above-average digital maturity score are significantly more likely to say that their income is growing. In a similar manner, data from both Canada and Australia/New Zealand show that those with below-average digital maturity score are significantly more likely to say their income is declining.

These findings confirm that tech-savvy nonprofits are often better able to capitalize on opportunities that help them grow.

Fundraising Challenges

The current economic landscape—and subsequent fewer donations—continues to challenge the sector again this year. Participants in each region shared that it’s, by far, the main fundraising challenge the sector will face over the next three years.

Interestingly, public perceptions of the sector also concern significantly more than in 2023. Further regional qualitative research highlighted globally needed changes to the narrative around cost of fundraising and the impact of the nonprofit sector.

Social media, especially, took the spotlight as a challenge when it comes to public perceptions. While these platforms can help charities reach wider external audiences, they also give space for anonymous and polarized opinions around the deserving or undeserving beneficiaries.

Fundraising Opportunities

When asked what would bring the biggest value, participants in each region ranked improved data management the highest. It’s also evident that smaller nonprofits are more likely to see value in working with partners to reach new audiences, whereas larger nonprofits rank integrated technology solutions as the biggest value opportunities.

Artificial Intelligence

AI has taken the world by storm. Considering the recent AI-related innovations, we wanted to identify if AI is influencing the nonprofit sector. Attitudes towards AI differ significantly across participants, but most use AI in all regions:

While predictive and generative AI are the two types of artificial intelligence most relevant in fundraising, the data suggests that nonprofits globally are mainly using generative AI. Only 10% of participants in the UK and Canada shared that they use predictive AI. The figure is slightly higher in Australia/New Zealand at 14%.

Most participants also have concerns about the technology, mainly to do with misinformation, data security and bias. Despite this, very few say their nonprofit has an AI policy in place—at 5% in the UK, 5% in Canada, and 6% in Australia/New Zealand.

Considering the speed of AI adoption, it is vital that nonprofit-wide policy making is accelerated, especially when most participants say they, in fact, already use AI.

CRMs and Technology Ecosystems

We then focused on the CRMs and technology ecosystems nonprofits have in place. Most participants shared that their nonprofit has a CRM solution.

Attitudes towards CRMs are also similar across regions. The vast majority agree that their data is secure, and many also think that their CRM improves overall performance, helps to build stronger relationships with supporters and is easy to use.

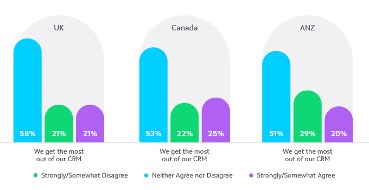

However, the data also reveals that nonprofits globally struggle to get the most out of their CRM:

Interestingly, even though most say that they are not getting the most out of their system, none of the regions rank technology training as a key opportunity that would bring the most value.

Despite this mismatch, most are satisfied with their CRM:

- In the UK, 43% are moderately or very satisfied, and a further 23% are neither satisfied nor dissatisfied.

- In Canada, 52% are moderately or very satisfied, and a further 19% are neither satisfied nor dissatisfied.

- In Australia/New Zealand, 48% are moderately or very satisfied, and a further 25% are neither satisfied nor dissatisfied.

When looking into technology ecosystems, it’s clear that integrated solutions are a rare thing in the sector. Only a handful of respondents said their tech stack is perfectly integrated, rounding down to 0% in all three regions.

Unsurprisingly, tech-savvy nonprofits are more likely to say their tech stack is either reasonably or well integrated.

In the UK and Australia/New Zealand, email marketing is the most popular solution for CRMs to integrate with. In the UK, this is followed by reporting and analytics and payment processing, whereas donation forms take the third spot in Australia/New Zealand. In Canada, payment processing was rated as the most popular integration, followed by donation forms and email marketing systems.

Global Takeaways on Fundraising in 2024

Naturally, fundraising and the nonprofit sector look different in each region—impacted by the differences in local political landscape, geography, history, demographics, culture and more. Nonetheless, our 2024 research revealed various globally relevant findings that give nonprofits across the world excellent insights on current trends, opportunities, and successful strategies.

While it’s evident that the economic challenges have had a big impact on the sector, there are many encouraging trends. From income stream diversification to early tech-adoption and exploring innovations like AI, these findings propose that nonprofits of all sizes can seek to take agency over how they approach innovation to boost their growth.

New or ongoing external factors are always going to come into play, but it’s encouraging that being more intentional about trying new fundraising activities or strategies can lead to success.

Eager to learn more? Download each regional report for free to explore these findings in more detail.