What Every Nonprofit Needs to Know About Financial Audits

The term “audit” tends to strike fear into the hearts of organizational leaders and individual taxpayers alike. Most likely, the first thing that comes to mind is an IRS agent picking through your financial details with a fine-toothed comb. But as a nonprofit professional, you don’t have to feel this fear regarding your organization’s audits!

Audits are actually essential to build a strong managerial and financial foundation for your nonprofit. Although it takes time and effort to prepare effectively for an audit and improve your operations based on the results, the many benefits of nonprofit audits make it all worthwhile.

In this guide, you’ll learn four key things you need to understand about audits as a nonprofit professional. Let’s dive in!

1. Most nonprofit audits aren’t conducted by the IRS.

There are two common misconceptions among nonprofit leaders about auditing. Some professionals automatically associate audits with the IRS, while others think that because their organizations are exempt from paying federal taxes, they’re also exempt from government-led audits.

The truth lies somewhere in the middle. The IRS occasionally audits nonprofits, but this usually only happens if an organization fails to file its annual Form 990 or a reporting discrepancy is found. Your nonprofit can also conduct several other types of audits independent of the government, including:

- External financial audits, in which a third-party auditing firm reviews your financial reports, transaction records, and accounting practices to provide an objective perspective on your organization’s financial health and compliance.

- Internal financial audits, where your team reviews its own documentation and procedures to identify opportunities for large-scale improvement in your financial strategy.

- Compliance audits, which ensure your nonprofit’s adherence to federal, state, and local government regulations, as well as your organization’s bylaws and other policies across all aspects of your work.

- Operational audits, which assess your organization’s internal systems, productivity, staffing, and management practices. These often look specifically at one area of your operations, such as technology, data management, or human resources.

This article will focus on external financial audits because they’re most often conducted on a recurring basis—and sometimes, your organization will have to do so to comply with regulations.

2. All nonprofits can benefit from audits, but only some are required to conduct them.

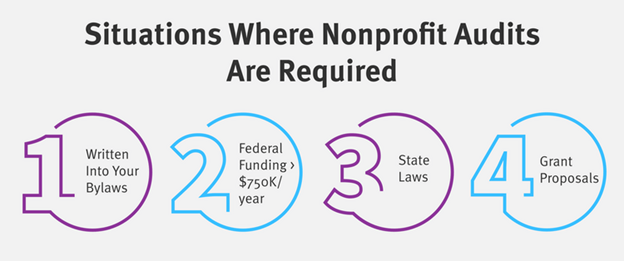

There are four reasons why your nonprofit could be required to undergo a financial audit:

- Your bylaws state that your nonprofit has to conduct regular audits to promote internal financial accountability.

- Your organization receives more than $750,000 in federal funding per year.

- Your total annual funding exceeds your state’s legal threshold for conducting an audit (usually $500,000).

- You’re applying for a grant that asks you to submit an audit report along with your proposal to demonstrate your nonprofit’s good financial standing.

Even if none of these conditions apply to your organization, you may still choose to conduct audits. By undergoing an audit every year—or even every few years—your nonprofit can maintain high internal standards for financial management, discover clear opportunities for improvement in your processes, and boost your reputation by being more transparent about your financial situation with your community.

3. Finding an auditor is typically the most time-consuming part of the audit process.

Generally speaking, the nonprofit financial auditing process has four stages:

- Finding an auditor

- Preparing for the audit

- Conducting the audit

- Making changes based on audit findings

The first step, finding an auditor, tends to be the most involved for your team. Once you’ve found one, you’ll usually receive clear guidelines to prepare for the audit (more on this later). Then, the auditor does the work of conducting the audit, and implementing recommendations can take varied amounts of time depending on your results.

Here are some tips for choosing the right auditor for your organization:

- Start your research online. Always include “nonprofit” in your search terms (e.g., “best nonprofit auditing firms” or “nonprofit auditor near me”) to find an auditor with experience in your sector. Browse their websites, check out their pricing options, and read reviews from past clients to help you narrow down your list.

- Leverage your network. If other nonprofits in your area have recently conducted audits, reach out to them to see who their auditor was and what they thought of the experience. Your organization’s accountant can also be helpful here—they typically won’t audit your nonprofit themselves to avoid a conflict of interest, but they can use their knowledge of the nonprofit finance space to recommend auditing firms.

- Issue an RFP. Once you’ve found a few top candidates, a formal Request for Proposals (RFP) allows you to compare their approaches, fee structure, projected timeline, and references side by side to find the best overall fit for your nonprofit.

- Meet with your top choice. Before you officially start working with your auditor, meet with them face-to-face to get an idea of how well they’ll collaborate with your team. This is also a good time to hammer out the details of your contract for working together before you finalize it and make it binding.

Finding the right auditor for your nonprofit often takes one to three months, plus you’ll need to figure in two weeks to a month for prep work and about the same amount of time for conducting the audit. Especially if your audit is required and you have a deadline, plan ahead accordingly. In particular, you’ll likely want to request a formal extension of your Form 990 deadline, not only to avoid having to complete that form and manage the auditing process at the same time, but also so your tax return can reflect the improvements you make based on your audit findings.

4. Completing prep work will help your audit go more smoothly.

Your auditor will need access to various financial documentation to conduct your nonprofit’s audit effectively. They’ll usually issue a Provided by Client (PBC) list to your organization to ensure they have everything at the beginning of the process. This list will ask you to pull materials like (but not limited to) your nonprofit’s:

- Bank account, credit card, and investment statements

- Annual financial statements (statement of activities, statement of financial position, cash flow statement, and functional expense report)

- Recent tax documents (Form 990s and employer tax forms like W-2s and 1099s)

- Payroll and staff compensation details

- Board member names and meeting minutes

- Information about major donations and grants received

- Any unpaid invoices in your system

- Fiscal policies and procedures handbook

Compile all of these documents in a digital folder you can easily share with your auditor, and provide view-only access to your fund accounting system so your audit team can access your statements directly. Additionally, take some time to review your organization’s financial records and address anything the auditor might inquire about, such as coding errors, uncleared transactions, undeposited funds, or incorrect categorization of assets. If you need help or have any questions about audit prep, consult your accountant.

Once the auditor finishes their work and compiles their findings, the results likely won’t be perfect, especially if it’s your nonprofit’s first time undergoing an audit. However, what truly matters isn’t how many recommendations your auditor makes—it’s how quickly you act on them and how dedicated you are to improving your organization’s processes. Sit down with your leadership team and financial professionals shortly after receiving your report and create an action plan to set your organization up for short- and long-term financial success.