Statement of Financial Position: A Look at the “Balance Sheet” for Nonprofits

A Statement of Financial Position is a report used by nonprofits to provide a high-level summary of the financial status and health of an organization. Often called a “balance sheet” in the for-profit industry, this document details both assets and liabilities in one consolidated view.

In this article, learn what’s included in a Statement of Financial Position, examples for nonprofit organizations, and how they might differ from what’s on a balance sheet.

- Statement of Financial Position Example

- What’s Included in a Statement of Financial Position

- How Do Nonprofits Use Statements of Financial Position

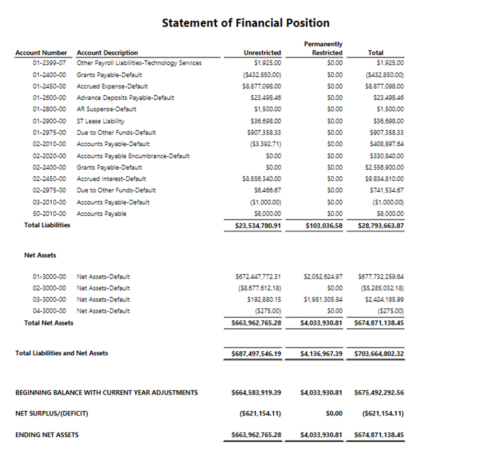

Statement of Financial Position Example

Most fund accounting software platforms have reports like your statement of financial position as one of your pre-built templates. Here is what one from Blackbaud Financial Edge NXT® looks like.

What’s Included in a Statement of Financial Position?

Your Statement of Financial Position helps you accurately depict your financial health. This statement encompasses various categories of assets and liabilities, offering a comprehensive view of your organization’s fiscal status.

Assets

Assets are anything your organization owns, controls, or is entitled to. Commonly, this includes cash, investments, inventory or supplies, and property. However, there are a number of other key assets that a Statement of Financial Position summarizes for the organization.

It is helpful to think about these various assets within two categories: “current assets” and “noncurrent assets”.

Current assets are most commonly defined as assets that are either already liquid (cash) or can be expected to be converted to cash within a year if needed. Examples of current assets include:

- Cash and Cash Equivalents: Cash-in-hand or readily available funds, bank balances, and other highly liquid investments, such as cash donations received from a fundraising event.

- Accounts Receivable: Money owed to the nonprofit by donors, grantors, or other entities, such as donor pledges that are recorded as receivables until the funds are received.

- Inventory: Goods that can be sold, including any materials, items in production, and finished products, for example, medical supplies for a health clinic.

- Prepaid Expenses: Payments made in advance for services or goods to be received in the future, including a pre-paid annual insurance policy.

- Marketable Securities: Investments that can be easily converted into cash within a year, such as stocks and bonds. For example, a nonprofit might invest in short-term Certificates of Deposit (CDs) that can be liquidated quickly if necessary.

Noncurrent assets are the opposite—they are longer-term investments or more highly-illiquid assets that are unlikely to be converted to cash within a year if needed. Examples of noncurrent assets include:

- Property, Plant, and Equipment (PP&E): Physical assets like land, buildings, machinery, and equipment used in the company’s operations. For example, a nonprofit might own a community center with office equipment and furniture that would be considered noncurrent assets.

- Long-term Investments: Investments intended to be held for more than one year, such as stocks, bonds, or real estate. This would include an organization’s endowment that is invested in long-term securities.

- Intangible Assets: Non-physical assets that have economic value, such as patents, trademarks, copyrights, and goodwill. Your organization’s trademarked logo or copyright on educational material would be considered intangible assets.

- Deferred Tax Assets: Future tax benefits resulting from differences between accounting and tax treatment of transactions. This type of noncurrent asset is uncommon in the nonprofit space because of the tax-exempt status of most organizations.

- Other Noncurrent Assets: Any other long-term assets not classified in the above categories, such as long-term receivables, such as a 20-year donor commitment from a donor, or advances to suppliers.

On the statement itself, assets are typically ordered by level of liquidity, starting with the most liquid assets (almost always cash), and moving through to the least liquid (most often things like intangible assets or long-term investments).

Separating assets into these categories and ordering by liquidity makes it easier for those reading the Statement of Financial Position to understand how these assets may be used in the future and get a clear picture of financial stability.

How are Assets Different in Nonprofit Accounting Systems vs Commercial Accounting Systems?

Assets share many similarities whether under the umbrella of a for-profit organization or nonprofit organization, but there are also some notable differences in source, usage, and terminology.

| Item | For-Profit Organizations | Nonprofit Organizations |

|---|---|---|

| Asset Source | Income is primarily generated from sales and investors. | Income is primarily generated from donors, grants, and other revenue-earning activities. |

| Usage Restrictions | Rarely applicable | Common; assets can be donor-restricted (purpose specified by the donor). Read our fund accounting basics guide. |

| Performance Measurement | Return on Assets (ROA) and other profitability ratios. | Focus on demonstrating resource use for mission fulfillment. |

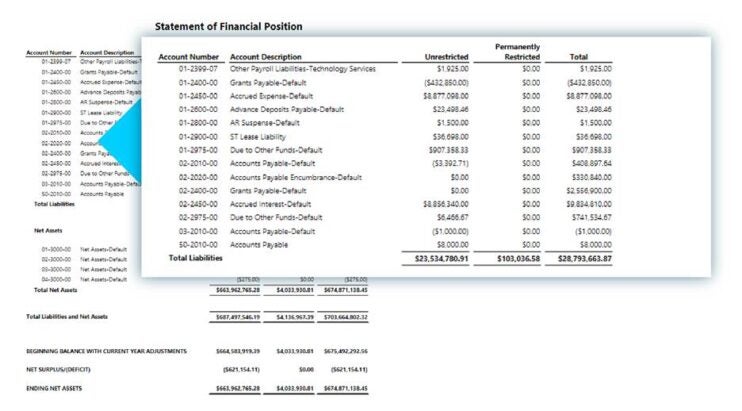

Liabilities

Liabilities are anything your organization owes, whether externally to vendors or creditors, or internally, such as staff. Similar to how assets are organized, liabilities are also categorized into current and noncurrent, or long-term, buckets for easier review.

Using the same logic as assets, current liabilities are those that can be expected to be settled or resolved within a year, and noncurrent liabilities are those obligations that are either due or expected to be settled beyond one year.

Here are some of the core components in each category:

Current Liabilities

- Accounts Payable: These are amounts owed to suppliers for goods or services received. For example, an outstanding invoice to a catering company that provided food for a fundraising event.

- Short-term Debt: Your short-term debt includes loans and other debt mechanisms that are due within the next year. Nonprofits might need short-term loans to cover operational expenses until donations are received, and these would be considered current liabilities.

- Accrued Expenses: These are costs incurred but not yet paid, such as wages, interest, and utilities. They would include staff paychecks that will be paid in the next payroll cycle, for example.

- Deferred Revenue: This is payments received in advance for goods or services to be delivered later. For example, a nonprofit receives $10,000 upfront for a training session that will be done next quarter.

- Current Portion of Long-term Debt: The portion of long-term debt due within the next year, for example your current mortgage on an office building, would be considered a current liability.

- Taxes Payable: Taxes payable would be taxes owed to governmental authorities but not yet paid. This doesn’t often apply to nonprofits because they are tax-exempt, unless they need to classify unrelated business income tax (UBIT).

Noncurrent Liabilities (aka “Long-Term Liabilities”)

- Long-term Debt: Long-term debt includes loans and other debt mechanisms with maturities exceeding one year, such as bonds, mortgages, or a long-term loan to renovate a nonprofit’s facility.

- Deferred Tax Liabilities: These are taxes payable in future periods due to temporary differences between accounting and tax reporting and would only apply to a nonprofit with a UBIT.

- Pension Liabilities: These are obligations for future retirement benefits owed to employees. Nonprofits with a pension must account for future pension plan payments.

- Lease Liabilities: Any long-term obligations under lease agreements would fall under noncurrent liabilities. For example, if your organization rents office space on a multi-year lease, the future years would be part of your noncurrent liabilities.

- Provisions: These are liabilities of uncertain timing or amount, such as an amount set aside to cover potential legal settlements.

- Other noncurrent liabilities could include deferred revenue and contingent liabilities. For example, a nonprofit receives a multi-year grant with specific conditions that need to be met over the course of several years.

Within the Statement of Financial Position, liabilities are ordered by maturity, so current liabilities are listed before noncurrent liabilities.

The breakdown and organization of the liabilities within the document allow the reader to better understand and manage the organization’s debt, meet financial commitments, and plan for future operations.

How are Liabilities Different in Nonprofit Accounting Systems vs Commercial Accounting Systems?

Like assets, liabilities also look and function similarly across for-profit organizations and nonprofit organizations, but there are a few notable distinctions.

| Item | For-Profit Organizations | Nonprofit Organizations |

|---|---|---|

| Deferred Tax Liabilities | Sometimes owe taxes in the future due to temporary differences. | Generally not applicable as nonprofits are tax-exempt. |

| Restricted Liabilities | Rarely applicable. | May include donor restrictions requiring liabilities to be settled in a specific manner. |

| Performance Measurement | Debt-to-equity ratio and other leverage ratios. | Focus on how liabilities are managed to support the mission. |

It’s also worth noting that for-profit organizations might end up with more liabilities than a typical nonprofit. Because these companies are motivated by profit instead of a mission, they are more likely to use debt to finance growth and scalable investments. Large nonprofits can have more complex accounting needs, but are generally more sustainable and risk-adverse in nature.

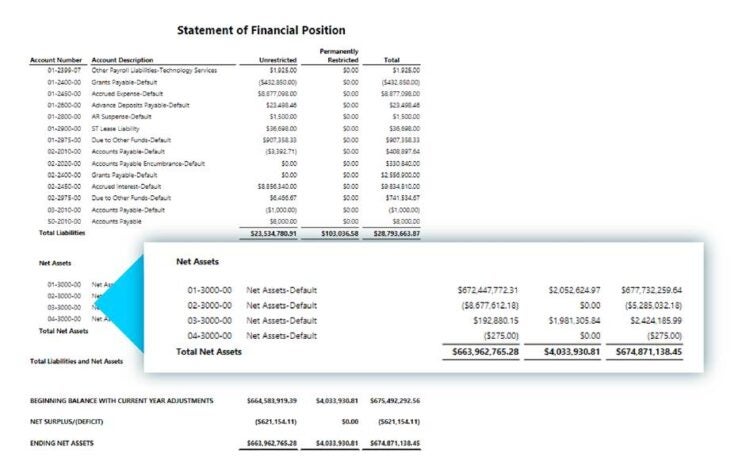

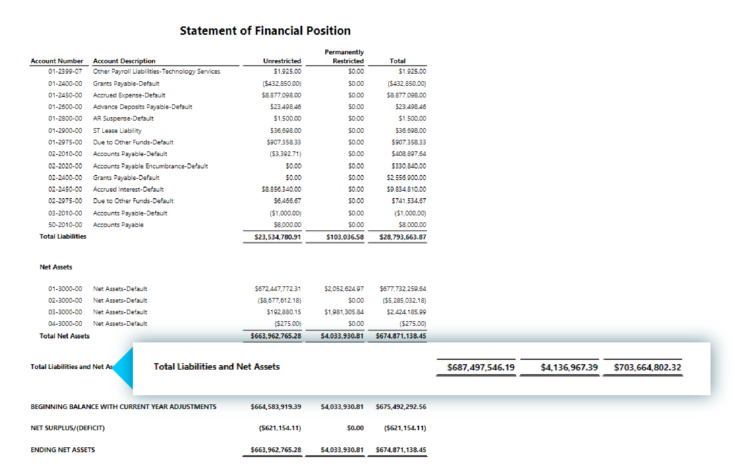

Net Assets

Net assets within a Statement of Financial Position refer to the residual amount after subtracting the total liabilities from the total assets. Stated as a simple equation:

Net Assets = Assets – Liabilities

If the equation yields a positive result, assets are greater than liabilities, then your organization has positive net assets, or a surplus in assets. When liabilities are greater than assets, an organization has negative net assets, or a deficit in assets.

Understanding the net asset position of a nonprofit organization is an important aspect of financial management, allowing for you to plan for future efforts, act on your organization’s mission, and ensure its strength and longevity.

For nonprofits to truly plan and take informed action, you should note a key nuance within the net assets portion of the statement of financial position—the difference between restricted and unrestricted funds.

While the quick net assets calculation will provide the bottom-line financial standing of the organization, you need to understand how the remaining assets can be deployed. Providing that detail on the statement of financial position allows the reader to quickly determine where the organization stands at a more detailed level.

Specific tracking of funding by limitation under the net assets section of the statement of financial position is a unique aspect of financial management in the nonprofit space. Donors will often earmark their contributions for specific causes, making those funds restricted for that specific use. Other funds, donations, or revenue may be unrestricted and used wherever the nonprofit deems necessary.

Critically, a nonprofit must call out these two distinct types of funding on their financial summary documentation to ensure they are viewed and used appropriately.

How are Net Assets Different in Nonprofit Accounting Systems vs Commercial Accounting Systems?

What is the main difference between a Statement of Financial Position and a Balance Sheet?

- On a Balance Sheet of a for-profit company, the remaining balance is most commonly called equity or capital.

- On a Statement of Financial Position for a nonprofit, this same remaining balance is called net assets.

The slight difference in the terminology used here underlies the core purpose of the respective entities themselves.

Remaining assets of a nonprofit organization do not belong to any individuals, company, or owners, rather there is simply a remaining asset balance to be used by the nonprofit, either restricted by donors for specific use, or unrestricted and available for use at the full discretion of the nonprofit.

It’s also worth noting that the concept of restricted and non-restricted assets only applies to nonprofit organizations. For-profit organizations simply do not have this limitation that must be considered by nonprofits.

How do Nonprofits Use Statements of Financial Position?

Statements of Financial Position is a great tool to create awareness and transparency for your board and stakeholders. It’s also a key resource for planning, budgeting, and decision making. Here are a few ways your Statement of Financial Position can support your long-term goals.

- Transparency and Awareness: Nonprofits use the Statement of Financial Position to create transparency of the financial status of their organization to anyone who needs to know. This often includes the Board of Directors to aid in their oversight, management, and support of the organization, as well as key stakeholders like donors, regulators, and the general public.

- Financial Health Assessment: Nonprofit managers use this document as an important tool to understand and manage the finances of the organization. A manager can quickly evaluate debt, liquidity, and solvency in one place, facilitating thoughtful decision making and providing a clear understanding of the stability of the entity.

- Compliance and Reporting: The Statement of Financial Position plays an important role in complying with legal and regulatory requirements at all levels, including local, state, and federal (where applicable). It shows funding and donation restrictions and that you are adhering to the restrictions.

- Planning and Decision Making: Your financial team can use this document to construct and modify your budgets, allocate resources, help your leadership make hiring decisions, evaluate fundraising progress and effectiveness, and plan for projects in the future.

- Fund and Investment Management: Your team might also use the Statement of Financial Position to determine your investment performance and plans, manage your endowment if you have one, and allocate restricted and unrestricted funds to their appropriate purposes or projects.

When starting a new project or attempting to solve a problem that in any way involves finances, your first stop should be the Statement of Financial Position. This high-level overview provides the clearest picture of financial standing for the organization and often serves as a roadmap to decision making.

Customize Your Nonprofit Financial Reporting with Blackbaud Financial Edge NXT®

With a fund accounting system built for nonprofit organizations and educational institutions, you have important templates like your Statement of Financial Position right at your fingertips. No need for additional spreadsheets to help you manage restricted funds or spending hours configuring a for-profit balance sheet template to meet your needs.

If you are ready for an accounting system that understands the needs of your organization, check out our guide, How to Save Time and Make Informed Decisions with Blackbaud Financial Edge NXT Reports.