Transforming Fund Accounting: How AI Built for Nonprofits Delivers Unmatched Value

Nonprofit finance professionals like you know the weight of an overloaded to-do list, where 25 hours a day still wouldn’t be enough to check everything off. Part of that is because accuracy is non-negotiable in your work. From running detailed reports to expense management and general ledger reconciliation, it doesn’t matter if it’s done if it’s not done accurately.

Artificial intelligence is reshaping the way nonprofits operate, offering the precision, speed, and reliability finance teams need—when crafted for nonprofit-specific challenges. Generic AI tools can often hinder more than they help, adding complexity rather than clarity. Purpose-built AI for nonprofits uses sector-relevant data and tailored workflows to empower finance professionals with actionable insights.

When advanced AI meets nonprofit expertise, the result is a financial process that aligns seamlessly with your mission, enabling you to dedicate more energy to the strategic work that makes a difference.

Why AI Matters in Fund Accounting

Fund accounting for nonprofits isn’t like traditional accounting. It’s defined by complexity—managing restricted funds, adhering to compliance requirements, and ensuring the stewardship of donor dollars. AI provides a transformative way to simplify these challenges.

For starters, nonprofit funds are often restricted, meaning the money cannot be freely reallocated. Unlike commercial systems, which assume money is fungible, nonprofit systems must precisely track which dollars can go where. AI, trained on nonprofit-specific workflows, can make this process faster and more reliable. From accounting for the nuances of restricted funding to tracking grants and endowments, AI ensures every dollar is accounted for appropriately.

AI can also support the important compliance tasks your accounting team handles. Nonprofits operate under strict regulations and often need to prepare for audits or produce reports for donors and funders. AI tools can streamline these efforts by identifying potential discrepancies, ensuring financial data is audit-ready, and preparing reports faster for greater transparency and oversight.

AI helps finance teams produce accurate and timely reports, proving the organization’s fiscal responsibility to funders and strengthening donor relationships. With these tools, you can shift your time from chasing down data to delivering strategic insights.

Practical Use Cases of AI in Financial Edge NXT

Blackbaud Financial Edge NXT® is paving the way for nonprofits to adopt AI responsibly and effectively. With a history of incorporating AI-powered functionality into our products, we’ve developed solutions tailored to the unique needs of nonprofit finance teams. Here are some new tools currently in development and designed to enhance your daily workflows:

Blackbaud AI Chat

Blackbaud AI Chat is an AI assistant that understands your data and can provide answers in seconds. Whether you’re comparing budget vs. actuals, summarizing financial performance, or creating dunning letters for past-due customers, the feature can distill critical information at a moment’s notice. It’s like having a financial analyst on demand.

Intelligent Home Pages

Your financial dashboard should be more than just a static overview. With Intelligent Home Pages, you get a dynamic experience tailored to your organization’s needs. From project and grant metrics to cash flow and budget analysis, these dashboards surface anomalies, prioritize what requires attention, and adapt to your workflows with customizable views and helpful shortcuts.

Spend Management

Managing purchase requests and approvals across an organization can be tedious. Spend Management powered by AI centralizes this process, providing a one-stop solution where you can submit, approve, and track expenses in real time. By improving visibility and streamlining workflows, it ensures financial efficiency and oversight.

AI-Driven Invoice Scanning

Manual invoice processing is a task of the past. This upcoming feature will allow you to upload invoices via phone or computer, with AI automatically extracting key details for human verification. This not only reduces data entry errors but also saves significant time, freeing your team to focus on higher-value tasks.

What’s Coming Next: Agentic AI

The future of AI in fund accounting is not just about reactive tools—it’s about proactive solutions. Blackbaud is exploring agentic AI, a new generation of autonomous tools designed to tackle more complex processes while keeping you in control.

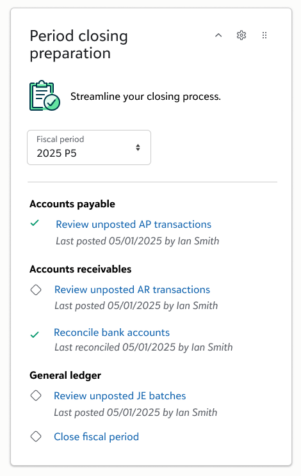

Closing your books can be a time-intensive process. New close management capabilities will automate background tasks like reconciling transactions, posting invoices, and flagging anomalies. By identifying discrepancies early, it reduces financial risks and speeds up the close process.

Imagine a virtual assistant that helps you stay on top of pledges and invoices. The collections agent will work across Blackbaud products, following up on outstanding payments and ensuring nothing slips through the cracks. With its ability to seamlessly integrate across systems, it offers a unified approach to managing your finances.

Agentic AI represents a leap forward in efficiency and risk management, allowing your team to focus on strategic decisions rather than routine tasks.

Building Trust with AI

AI is only effective if it fosters trust—both within your organization and with external stakeholders. Blackbaud’s approach to Intelligence for Good ensures that these AI-powered tools are built with integrity, security, and oversight at the forefront.

Data integrity is essential in fund accounting. Blackbaud’s closed-loop systems are designed to ensure that all inputs and outputs are verified, maintaining accuracy and reducing the likelihood of errors.

AI is a powerful partner, but humans remain in control. Features like human-in-the-loop workflows mean that you can review, override, or disable AI functionality as needed, ensuring it complements rather than replaces your expertise.

Every tool is built with the unique needs of nonprofit finance in mind, from restricted fund tracking to compliance with reporting standards. This means you can adopt AI confidently, knowing it supports your mission and strengthens your stewardship efforts.

AI isn’t here to replace nonprofit finance professionals—it’s here to empower you. By automating tedious tasks, surfacing critical insights, and providing tools that understand your nonprofit’s unique needs, AI enables you to focus on what matters most: driving your organization’s mission forward.

Empowering Fund Accounting Through Intelligent Innovation

To see these advancements in action, check out the Financial Edge NXT roadmap and watch our latest Product Update Briefing. Learn how AI can help your finance team make smarter decisions, save time, and build trust every step of the way.