Fiscal Period Close Strategy for Nonprofits: Building a Stable Foundation

Does closing your books quickly every month feel more like an aspiration than a reality?

For many nonprofit finance teams, there just aren’t enough hours in the day—even when you are eating lunch at your desk and staying until 7 p.m. And you are in good company. According to Ventata Research, only 53% of organizations complete their monthly close within six days, and even then, many of them have to go back and make additional adjustments after the close.

An effective fiscal period close strategy is the backbone of sound nonprofit accounting. By overseeing the steps that track, verify, and report on your organization’s financial results, you ensure fiscal transparency and build trust with stakeholders.

Whether you work at a foundation, educational institution, or nonprofit, implementing a structured month-end, quarter-end, and year-end close process provides the stability needed to fulfill your mission and meet regulatory requirements.

What Is a Fiscal Period Close Strategy?

Your fiscal period close strategy is the process of tracking and finalizing financial data at the end of a reporting period—monthly, quarterly, or annually. For nonprofits, this involves a sequence of tasks done in a specific order and often under tight deadlines. To get the most accurate financial data for reporting, the process should happen 12 times a year at each month-end, four times a year at each quarter-end, and once at year-end.

Consistent closes help maintain accurate records, catch anomalies early, and prevent minor discrepancies from becoming larger problems. For example, a nonprofit that reconciles its books monthly can quickly spot misallocated grant revenue, correct it, and avoid issues during annual audits and grant reports. Plus, a consistent monthly close makes quarterly and annual closes less stressful because you aren’t trying to identify months-old outliers.

Benefits of a Strong Fiscal Period Close Strategy

A strong fiscal period close strategy results in data you can trust, leading to better reporting, budgeting, and forecasting. When your information is accurate, you can confidently make strategic decisions, such as launching new programs or expanding services. Here are some of the other benefits of a strong fiscal period close strategy:

- More Complete Reporting: You can be confident that there aren’t missing expenses or incorrectly allocated spending in your financial statements.

- Better Strategic Decision-Making: Your leadership is working with current and accurate data when they review the budgets, forecasts, and scenario planning, so they can better identify trends and get ahead of potential gaps.

- Faster Processes: You’ve addressed issues and have scalable close processes in place so pulling reports, managing audit prep, and creating budgets is easier and faster.

- Reduced Risk: You can identify and address any issues more quickly, and before they become problematic.

- Easier Tech Implementation: You can easily layer on automated processes and AI-enabled tools because underlying data is accurate and in a single source of truth.

- Reduced Stress: Your team can get reports out quickly and have time for more strategic analytics projects—and lunch breaks.

Ultimately, this efficiency translates to cost savings and a smoother workflow for your team.

Common Roadblocks to an Efficient Fiscal Period Close Process

The path to a seamless close is often obstructed by unclear roles, manual processes, and fragmented systems. Here are some of the most common challenges:

- Unclear roles and responsibilities: When team members aren’t sure who owns each step, tasks can slip through the cracks. Disconnected processes also make it difficult for individual team members to see how their part, like timely expense reports, impacts the bigger picture.

- Manual processes: Spreadsheets or hand-written approval processes not only slow things down but also introduce room for error. Waiting for the credit card statement to manually enter expenses one by one—instead of using an automated feed—slows your AP processes to a crawl.

- Conflicting priorities: Pressure to close quickly can compromise accuracy, especially if documentation is incomplete. Conversely, waiting to close until you receive invoices for costs incurred, even if those invoices arrive two weeks into the next month, makes it impossible to have an efficient fiscal period close.

- Lack of integration: Multiple data sources and formats require extra time and manual configuration to ensure consistency. Shadow spreadsheets and other systems also make it difficult to surface exceptions and understand where the problems actually came from.

- Reliance on institutional knowledge: Without documented procedures, critical information may be lost during staff transitions, and on-boarding new staff can create inconsistencies.

- Poor planning: If you neglect to align close tasks with audit and compliance needs, you can derail your close timelines.

Addressing these obstacles with clear policies, integrated systems, and standardized workflows is essential for a reliable fiscal period close process.

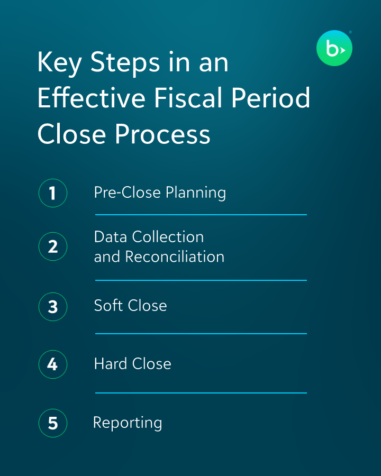

Key Steps in an Effective Fiscal Period Close Process

A successful close process follows a structured sequence of actions, each designed to ensure accuracy and compliance. Here’s how it unfolds:

Start with pre-close planning, where you establish a close calendar and clarify responsibilities for each team member.

Next, move to data collection, pulling information from subledgers and external sources. Reconcile your key accounts and ensure your bank statements match your ledger. Confirm that all grant income is recorded correctly. Review petty cash, inventory counts, and approve necessary journal entry adjustments to keep records clean. Update fixed assets, such as vehicles or equipment, and conduct a thorough financial review and analysis to confirm completeness.

Many fund accounting systems will allow you to do to a soft close, where you can prevent data entry but still make adjustments if you find an issue. A soft close is helpful after you have collected all your data but are still verifying everything is correct. Once you are confident all the data is in the system correctly, you can do a hard close to your fiscal period. Once you’ve done a hard close, any adjustments will need to be documented in the next fiscal period.

Reporting comes next, with the creation of financial statements like the Statement of Activities and Statement of Functional Expenses. Compliance checks and internal controls verify adherence to policies and regulations, followed by a final review and release of financial information. Depending on your organization, you likely share these reports with leadership, your board, and your fundraising or program teams.

Finally, conduct a post-close review to update procedures and archive records according to data governance policies. Each step builds on the last, supporting a transparent and efficient close.

How Fiscal Period Close Strategy Is Evolving

Technology is transforming the close process for nonprofits. Automation, document intelligence, and AI-enabled functionality are speeding up month-end and quarter-end closes and reducing manual effort. For example, automated reconciliation tools now match bank feeds with ledger entries in seconds, freeing staff to focus on analysis and strategy.

Document intelligence extracts data from receipts and invoices, while AI tools flag inconsistencies and suggest corrections before they become issues. As these solutions become more accessible, nonprofits can close their books faster, with greater accuracy and less stress.

Role of Connected Systems in Close Management

Connected systems, like your fundraising CRM or tuition management systems that are seamlessly integrated into your fund accounting system, play a vital role in streamlining your fiscal period close strategy. These platforms consolidate donor, tuition, and program data, reducing the need for manual entry and ensuring that information flows directly into your accounting software. When your revenue streams are logged automatically, your reconciliation is straightforward, and you minimize errors.

Leveraging these systems not only accelerates the close process but also strengthens internal controls and supports compliance.

Building Trust through a Strong Fiscal Period Close Strategy

A disciplined financial close process lays out the groundwork for data accuracy, reliable reporting, and effective AI integration. By overcoming common roadblocks and embracing new technology, nonprofits can maintain a stable financial foundation and make confident decisions for the future.

Ready to simplify your internal controls and enhance your fiscal period close strategy? Learn how fund accounting software can help by checking out our on-demand product tour for Blackbaud Financial Edge NXT®.