Statement of Functional Expenses: How Nonprofits Track Spending

A Statement of Functional Expenses (SFE) is a financial report used by nonprofit organizations to categorize and detail how funds are allocated across different functional areas.

This key document helps stakeholders understand your organization’s spending by breaking down expenses into specific functions, like programs, administration, and fundraising. It also helps reinforce that the majority of your organization’s financial efforts are directly supporting your goals.

How Do Organizations Use a Statement of Financial Expenses?

SFEs are used in three primary ways:

- Resource Allocation: SFEs allow your organization to monitor and manage how resources are being used across different functions, so you can be confident that a significant portion of expenses is directed toward mission-related activities.

- Transparency: By clearly showing how funds are spent, SFEs build trust with donors, grantmakers, and the public, demonstrating that the organization is using its resources responsibly and efficiently.

- Tax-Exempt Status: As a not-for-profit organization, you must prove that you are primarily engaged in activities that further your mission to maintain your tax-exempt status. SFEs provide evidence that the majority of funds are used for activities directly related to your mission, which supports compliance with IRS regulations. This is one of the key differences between nonprofit and for profit accounting.

What’s Included in an SFE Report?

An SFE report consists of two primary components, Functional Expenses and Natural Expenses, which together provide a comprehensive overview of how funds are allocated and spent within your organization.

Functional Expenses

Your Functional Expenses classify costs based on the purpose they serve within the organization. This view breaks down expenses into three primary categories:

- Program Expenses: Costs directly related to your organization’s mission and programs

- Administration: Expenses associated with administrative activities and the overall management of your organization

- Fundraising: Costs incurred during fundraising efforts, including donor outreach and campaigns

Natural Expenses

The second component of the Statement of Functional Expenses is Natural Expenses. Represented as the rows within the table, these line items categorize costs based on the type of expense rather than the purpose. Unlike Functional Expenses, Natural Expenses can vary significantly based on your organization, so the number of line items may differ from one organization to another.

Common categories include:

- Salaries and Wages: Expenses related to paying staff and employees

- Rent/Utilities: Costs associated with the organization’s physical space and utilities

- Insurance: Expenses for insuring business operations and any property owned by the organization

- Travel Expense: Costs incurred by staff or employees when traveling for work related to the nonprofit’s mission

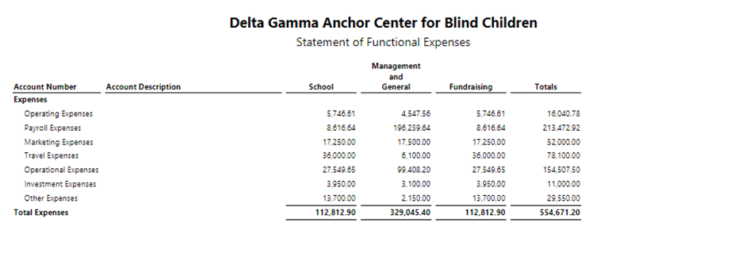

Statement of Functional Expenses Example

Below is an example of a Statement of Functional Expenses, generated through Blackbaud Financial Edge NXT®:

Having a platform specifically built for nonprofits can streamline your reporting process and make it easy to match expenses to restricted funding. These report templates are available within the system—you don’t need to spend hours getting a for-profit report to work or juggle problematic spreadsheets. This is just one of the reasons why accounting software is important for organizations to use.

What is the ideal ratio between the different functional expenses for a nonprofit?

There is no ideal ratio between the three functional expense categories. Each nonprofit has different factors, including the size of your organization and the scope of your programs, that affect your specific ratio.

Even though there is no ideal, your organization does need to demonstrate that a meaningful portion of its expenses is being allocated to its programs—and therefore its mission—to maintain its tax-exempt status.

Below is an example of how a healthy organization might balance the three functional expense categories:

- Program Expenses: Ideally, a significant majority of a nonprofit’s expenses should be allocated to programs and projects that address your mission, often recommended at 65%-75% or higher. This demonstrates that the organization is focused on its mission-related activities.

- Administrative Expenses: These typically make up 15%-25% of the total expenses. These costs are necessary for the organization’s functioning but should be kept reasonable to ensure that most resources are directed toward the mission.

- Fundraising Expenses: Usually, fundraising expenses should be 10%-15% of the total budget. Nonprofits need to invest in fundraising to sustain their operations, but excessive fundraising costs can raise concerns among donors and stakeholders.

SFEs are One of Four Main Nonprofit Financial Statements

While a Statement of Functional Expenses may not be the first financial document that comes to mind when thinking of key reports for stakeholders, it plays a critical role in informing the decision making for your organization.

Using your SFE in conjunction with the other three key financial reports, stakeholders should have a comprehensive view of the health and performance of the organization.

| Financial Statement | Purpose |

|---|---|

| Statement of Financial Position | A snapshot of a nonprofit’s assets, liabilities, and net assets at a given point in time, showing its overall financial health |

| Statement of Activities | A report detailing a nonprofit’s revenues and expenses over a period, reflecting the changes in its net assets |

| Statement of Cash Flows | A financial report that tracks the cash inflows and outflows of an organization, illustrating how cash is generated and used during a period |

| Statement of Functional Expenses | A financial statement that categorizes a nonprofit’s expenses by both their function and natural classification, providing insight into how resources are allocated toward various activities |

Statement of Functional Expenses FAQs

Here are a few common questions nonprofit finance professionals have about the statement of functional expenses.

What are the consequences of misreporting or inaccurately categorizing functional expenses?

Misreporting or inaccurately categorizing functional expenses can lead to significant issues, including:

- Regulatory Penalties: Fines or loss of tax-exempt status from the IRS

- Damage to Reputation: Loss of donor trust and negative public scrutiny

- Funding Impact: Reduced or lost funding and grant compliance issues

- Operational Challenges: Poor budget management and internal conflicts

- Increased Audit Risk: Greater likelihood of audits and the need for corrective actions

Accurate expense reporting is crucial for compliance, donor confidence, and effective resource management.

Is it a requirement to file the Statement of Functional Expenses?

Yes, it is required for most tax-exempt organizations as part of their annual Form 990 filing with the IRS. If the nonprofit organization is classified as a 501(c)(3), for example, it is mandatory to create and file a Statement of Functional Expenses.

This may vary based on the size and purpose of the organization. To be certain, please seek professional legal advice and check with your appropriate local, state, or federal regulators. If not filed, the organization may be subject to penalties or fines, reputational damage, and potentially loss of their tax-exempt status.

How often does a nonprofit need to produce and file a Statement of Functional Expenses?

A nonprofit organization typically needs to produce and file a Statement of Functional Expenses annually during year-end reporting.