Your New Budgeting Superpower: Program-Based Budgeting

As a nonprofit finance leader, you are constantly aware of the many different pulls on your funding availability. One program could use more headcount to serve more people. A new van can provide more opportunities for your senior care program. The best way to manage those differing priorities is through budget management tools that give you a clear view of each program, instead of trying to pull apart the organizational budget.

This is where your fund accounting system can help you get the granularity you need from your budgeting process to make data-driven decisions.

Budgeting by program with fund accounting software that has sub-fund capabilities provides a more nuanced financial management approach, enabling you to better prioritize and allocate resources to meet the diverse needs of your nonprofit organization.

The Benefits of Budgeting by Program for Nonprofit Organizations

As a nonprofit, you have to manage which funds are restricted and which aren’t. And don’t lose track of where they’re restricted to, either! On top of that, you have board and department budget priorities, as well.

The budget is an essential guideline and checkpoint in monitoring the ongoing success of a nonprofit organization. Rather than a sole focus on the bottom line, in the nonprofit sector, you recognize so many more facets of your financial activity than simply whether the entity as a whole turns a profit. For example, you need to make sure the grant or endowment money you are spending for a particular program is being spent according to the grant or endowment’s terms.

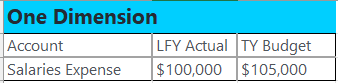

However, many traditional budgeting systems focus primarily on allocations for the specific types of revenue and expense lines, without further nuance on what areas of your organization are driving that flow of activity. Standard accounting systems often allow tracking and reporting against revenue and expense lines at the account level. This is sufficient for a basic overview of how money is being raised and spent, but for an organization accounting for different funds, that’s usually only one aspect of reality.

Using software without sub-fund tracking limits nonprofits to budgeting one-dimensionally. This leads to either the need to track further detail in spreadsheets, or to create an unwieldy and cumbersome chart of accounts to allow for a unique account record for every possible flavor of expense or revenue.

Here are three key benefits of using a fund accounting system with sub-fund capabilities to create budgets by program.

More Information At Your Fingertips

When budgeting with sub-fund capabilities, you no longer have these limitations. Now, instead of each dollar being budgeted to a single account, it can be tracked across accounts, programs, and even grants.

Look at how much more information the organization with fund accounting software with sub-fund capabilities has at their fingertips when budgeting for a single expense account. And because they’ve already started using this functionality for tracking their activity so far, getting actual breakdowns for informed budgeting is a snap! After all, if these multiple aspects of a transaction are already being recorded on the books, why not take advantage of using those actuals for building next year’s budget without ever leaving your software?

One dimension:

Fund Accounting with Sub-Fund Budgeting:

Extrapolating that out to a full budget, you can quickly and easily retrieve a budget at the program or grant level when needed, with the same level of ease as at the account level. At the push of a button, you can have a budget-to-actual comparison not just on your overall salaries spending, but also on salaries for your summer program that are covered by a grant from the city, quickly knowing how much remains in that grant budget without having to update and reconcile external spreadsheets.

Track Equity with Sub-Funds

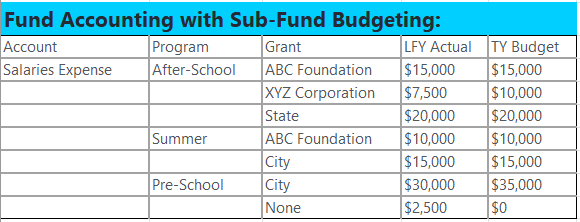

Now that you have a full picture of the nuance of where these budgeted funds are truly coming from or going to, there’s still more potential. To get a true picture of an organization financially, you must review both balances and activity. That’s why no financial reporting is complete without both a Statement of Activities and a Statement of Financial Position, or similarly functioning reports.

The organization above is using the previous year’s salary activity to help plan out the coming year’s budget. This is great for items that will be fairly consistent between the years, but what about when a department head comes to you to see if they can fit in a one-time stretch item in the budget?

Fortunately, a fund accounting system with sub-fund capabilities has the ability to track the equity within each sub-fund. The net assets portion of the balance sheet can be broken out by fund and sub-fund, allowing you to check with a quick glance how much the department has “in the bank.” And with both funds and sub-funds, you can elect which funds your sub-funds should retain equity in and which should “zero out” at the end of each fiscal year. Then, in the process of coming up with the budget for those sub-funds for the coming fiscal year, you can preview the impact on those balances your budgeted activities will have.

For example, your organization may budget a portion of unrestricted funds to a particular program, like a school club, that is “use it or lose it” for the school year. However, donations restricted to that club are carried over year-over-year in the restricted fund until they are spent. Budgeting within your accounting system allows you to plan for the expenses that will be covered by both unrestricted and restricted funds and preview the impact of that projected activity on your fund balance accounts with budget reporting.

In the income statement by fund summarized by program below, the revenue and expense amounts are pulling from the budget, but the beginning fund balance amounts are real. The mock close done by the report calculates the change in net assets and ending fund balance for each program and fund, giving feedback on the consequences of each budgeting decision.

Easily Test “What-If” Scenarios

Looking at the report above, you might want to double check whether any of the planned expenses for the Workforce Education Center could be covered by existing or expected restricted funds rather than pulling from unrestricted. You might remind your Domestic Relief Program manager that while they are budgeted to break even on revenue and expenses this year, they have a balance of $5,000 set aside that they should consider if, when, and how to use. And as soon as they make tweaks to the budget record in the accounting system, you can rerun this report and at the push of a single button get the whole financial picture.

Leverage the Power of Budgeting by Project with Blackbaud Financial Edge NXT

If you’re interested in how a true fund accounting system with sub-fund capabilities can make your budget season a breeze, sign up for a product tour today. And if you’re already a Financial Edge NXT user and you want to learn more about leveraging the built-in budgeting features in your system, come to the instructor-led Blackbaud University Budgets class for hands on practice.

Free Resource

Free Resource

Build Actionable Reports

How to Save Time and Make Informed Decisions with FENXT Reports