GAAP for Nonprofits: How to Reconcile GAAP and Non-GAAP Results

Have you ever had your board members scratch their collective heads when the development and finance teams report their results? Do you get questions on why the two never match up?

The quandary that faces every nonprofit management team is how to communicate the difference in GAAP to non-GAAP operating results. In many respects, it is the same challenge our for-profit friends face when they eliminate stock-based compensation from their financial statements, except in nonprofit accounting our challenges are on the revenue side of the equation.

With good training, clear reporting, and a little patience, you can help your nonprofit Board members understand the difference between the GAAP results your accounting team needs and the non-GAAP results presented by other areas of the organization.

What is GAAP and Why Is It Important for Nonprofits?

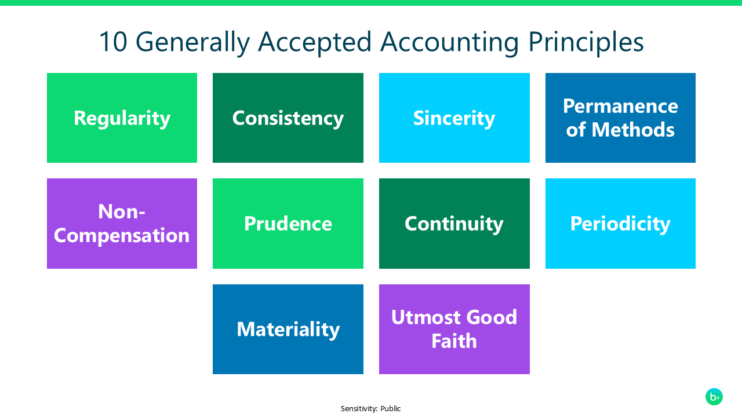

GAAP stands for generally accepted accounting principles. These 10 standards become a framework for tracking and reporting on your financial data. The GAAP framework helps ensure transparency and consistency across organizations.

Created in the wake of the stock market crash of 1929 and the resulting Great Depression, GAAP was developed and continues to be maintained by the Financial Accounting Standards Board (FASB), the SEC, and the American Institute of Certified Public Accountants (AICPA).

The principles apply to all accounting professionals but are especially important for nonprofits because they emphasize transparency and building credibility.

GAAP requires the accrual method of accounting, which matches the transaction to the time period when the activity occurs, not when it is paid. So, while bequests, insurance policies and planned gifts are exciting for the organization, those donations won’t be reflected in the GAAP reporting. Kudos to your development team for getting the payout from an insurance policy of a 45-year-old. But hopefully that person still has a long and fruitful life ahead of them, so your organization won’t see those funds for many years.

These standards also require restricted funds to be tracked separately, ensuring donor intent. Organizations cannot use restricted funds unless it aligns with what the grant or major donor wanted. Grant dollars earned specifically for one program cannot be used for a different program without the grantor’s consent.

Educating Your Board on GAAP for Nonprofits

My first couple of board meetings as a CFO were spent going down the rabbit hole of explaining why my development partners reported these great multi-million-dollar quarters, and I would show the board just how little cash came into the door and how much of that could actually be spent on the operations of the organization.

So, what can you do to eliminate these uncomfortable conversations?

Educate, educate, educate. Do you have board members who are members of the business community or are they from other disciplines that never have the need to understand a financial statement? Depending on their comfort discussing financial statements, craft a workshop that helps them not only understand the differences in not-for-profit versus for-profit accounting, but also what is considered a gift by your development staff versus what hits your financial statements.

- Does development count expectancies and bequests at face value or a discounted rate—do they record them at all?

- Do your development partners count conditional pledges?

- How do you explain the discount rate on multi-year pledges?

These are all areas that impact the variance between what you’re reporting and what the development office reports out.

Create a Simple Reconciliation Schedule

The simplest solution I found (after educating my board on the above issues) was to create a simple schedule that reconciled the non-GAAP development numbers back to what was reported in the financial statements.

The top of the schedule listed all GAAP revenue, including pledges, cash gifts, non-cash gifts, and irrevocable trusts. The report would show the subtotal of this revenue, and list the non-GAAP gifts below, such as bequests and revocable trusts. The total of the schedule then matched the numbers reported by the development team. Use clear labeling so your board members can easily see what is GAAP and what is non-GAAP.

By creating a simple, easy to follow reconciliation schedule, my development partner and I were able to clearly communicate the organization’s financial progress to our board.

Adhere to GAAP Standards with Fund Accounting Software

When you are focused on transparency and stewardship, you need to be able to track your revenue by fund and create reports to clearly show your financial data. Nonprofit accounting software allows you to track and report on your different funds, grants, programs, and projects in real time. It also integrates with your fundraising tools and automates the reconciliation process. With nonprofit accounting software, you can save time, reduce errors, and communicate your financial results clearly and confidently to your board and stakeholders.

How Development and Finance Can Get Along (Really!)Does your organization need a fund accounting system that makes it easy to adhere to GAAP reporting standards? Check out our buyer’s guide to help you make an informed decision about your accounting software.