Key Takeaways from the donorCentrics Sustainer Summit

Each year, the Blackbaud donorCentrics® Sustainer Summit brings together some of the nation’s leading fundraising organizations that are focused on growing their recurring giving programs. Participants compare fundraising strategies, share results, and explore sustainer growth and donor retention trends.

This analysis spans FY20 through FY24 (July to June fiscal years) and includes data from 19.4 million donors and $3.4 billion in charitable giving from a variety of nonprofit sectors. Data is drawn directly from participant CRMs and standardized for consistent comparisons.

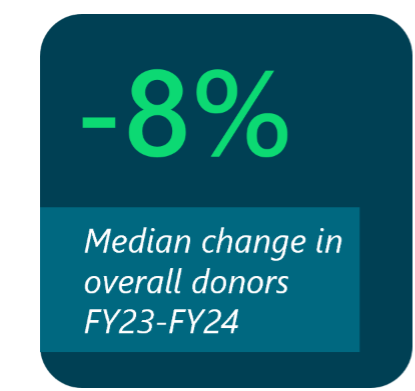

Changes in Overall Donors and Revenue

Donor Decline

Overall donor counts declined 8% from FY23 to FY24, the second consecutive year of steep donor declines. Throughout the five-year period from FY20 to FY24, donor counts dropped 15% as nonprofits moved beyond the surge in generosity seen during the COVID-19 pandemic.

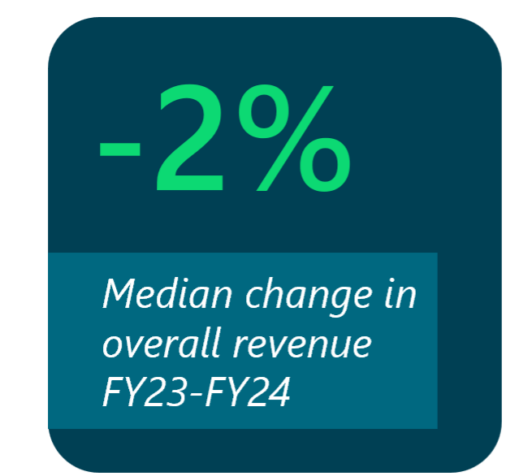

Revenue Stability

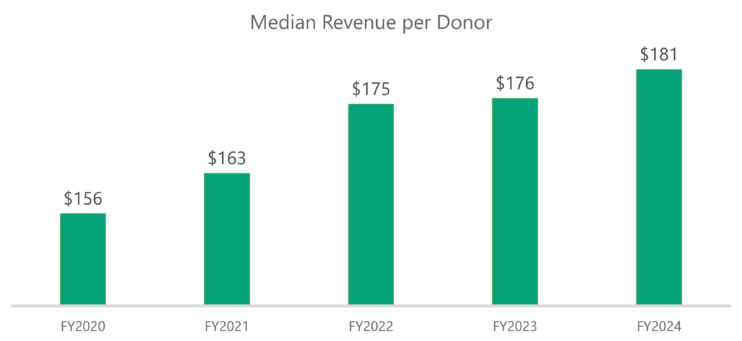

Despite donor declines, overall revenue showed greater stability, down just 2% from FY23 to FY24. This resilience can be attributed to increases in donor value metrics: revenue per donor rose from $156 in FY20 to $181 in FY24, reflecting a five-year trend of increasing cumulative value.

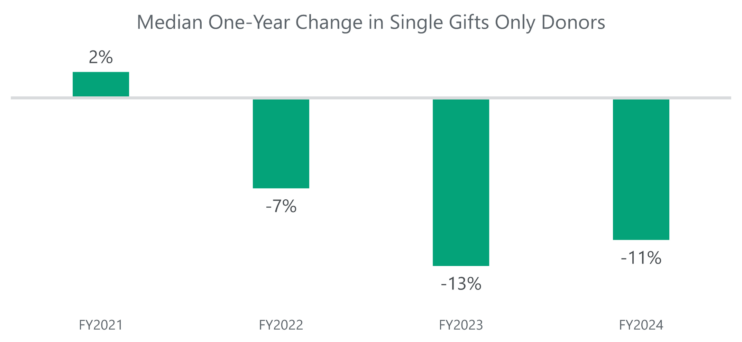

Shifts in Single and Recurring Gift Populations

Single Gift Declines

For the third consecutive year, overall donor declines were driven by sharp drops in single gift giving. From FY23 to FY24, the number of donors making only single gifts fell 11%, while recurring donor counts decreased by just 1%. In this analysis, single gifts refer to one-time contributions as opposed to recurring gifts made on a committed schedule (e.g., bi-weekly or monthly).

Revenue from single gift donors also declined–down 7% year over year. This population of donors reached a high point in FY20 and FY21 during the surge of generosity seen early in the COVID-19 pandemic. Over the five-year period from FY20 to FY24, single gift donors declined at a steep rate of 27%, demonstrating the unpredictable nature of one-time giving.

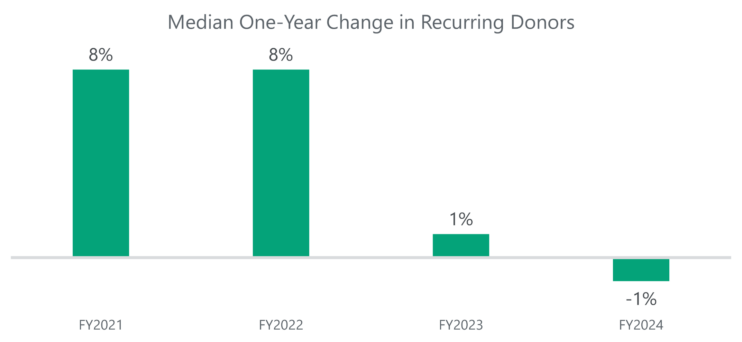

Consistency in Recurring Giving

The recurring donor population remained steady, producing a consistent and reliable source of revenue and support. The number of recurring donors was roughly flat, showing a modest 1% decrease from FY23 to FY24, while revenue from recurring donors rose by 1%. Over the five-year period since FY20, recurring donors have increased 17%, proving their resilience in a shifting fundraising landscape.

Recurring giving now represents a larger share of both donors and revenue. In FY24, 23% of donors gave on a recurring basis, up from 16% in FY20. These donors contributed 32% of total revenue, up from 26% five years ago, as organizations in this dataset have invested in growing their sustainer programs.

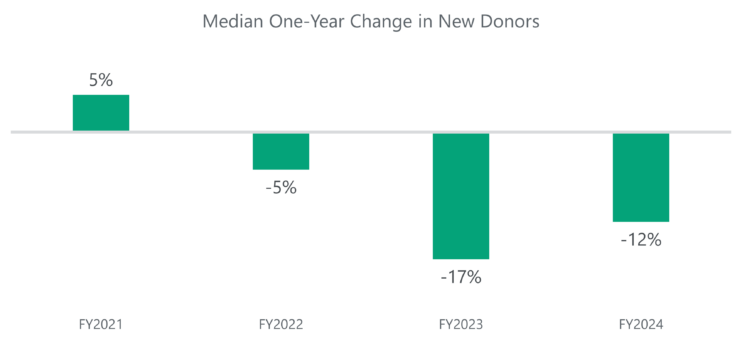

Trends in New Donor Acquisition

New Donor Decline

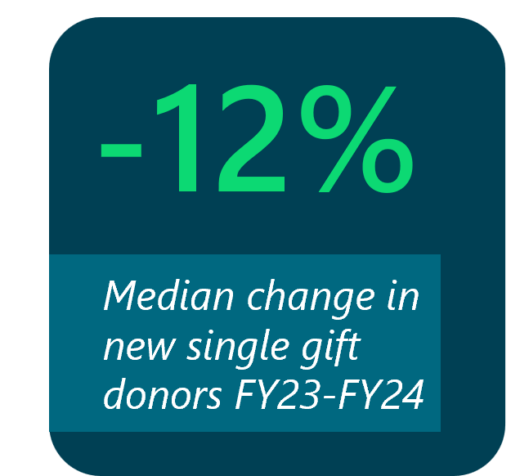

New donor acquisition declined 12% from FY23 to FY24, driven by a 12% decrease in new single gift donors. FY24 marked the third consecutive year of declines in new donors and a total drop of 29% over the five-year period from FY20 to FY24.

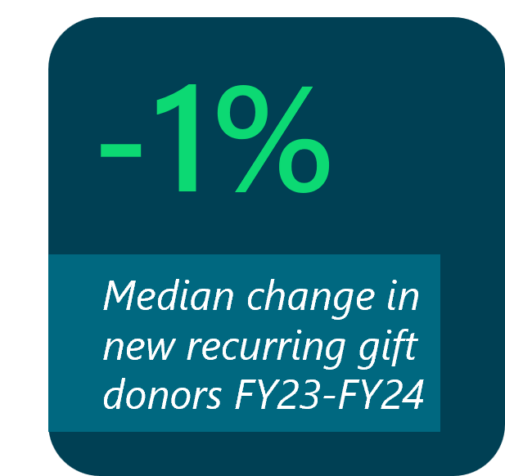

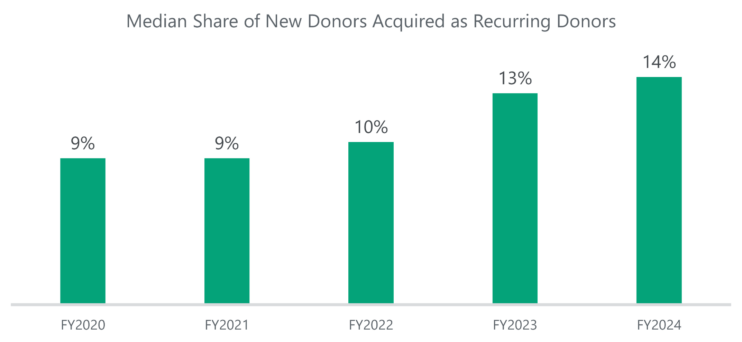

Recurring Gift Acquisition

The number of new recurring gift donors decreased slightly by 1% from FY23 to FY24. However, the share of new donors acquired with recurring gifts continued to grow, reaching 14% in FY24, up from a 9% share in FY20.

Top Channels for Acquiring New Recurring Donors

As organizations work to grow their sustainer programs, many are focusing on strategies that acquire donors directly into recurring giving. The following channels emerged as the most effective sources for bringing in new sustainers in FY24:

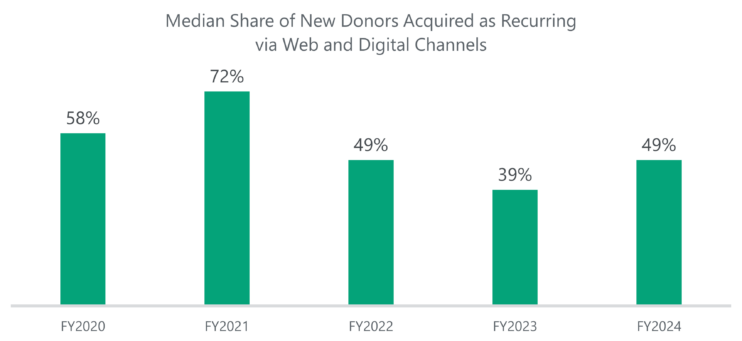

Web and Digital Channels

Digital channels are key for acquiring new donors directly to recurring giving. Nonprofits are applying and testing sustainer-forward messaging on websites, emails, SMS marketing, and through paid digital ads.

Most organizations in this benchmarking cohort default their online donation forms to a monthly recurring gift ask. A few organizations are also piloting an annual, auto-renewing recurring gift option on their giving forms as an alternative to monthly giving. A 49% share of new recurring gift donors were acquired through a digital channel in FY24.

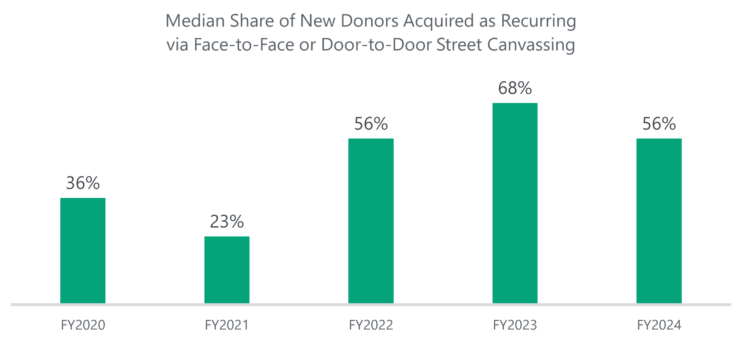

Canvassing

More than half of nonprofits in this data set leverage face-to-face and door-to-door street canvassing to accelerate recurring gift acquisition. Canvassing fundraisers connect with potential donors on busy street corners or at their doorsteps, focusing specifically on securing recurring donations. In FY 24, 56% of new recurring gift donors were acquired through face-to-face or door-to-door canvassing.

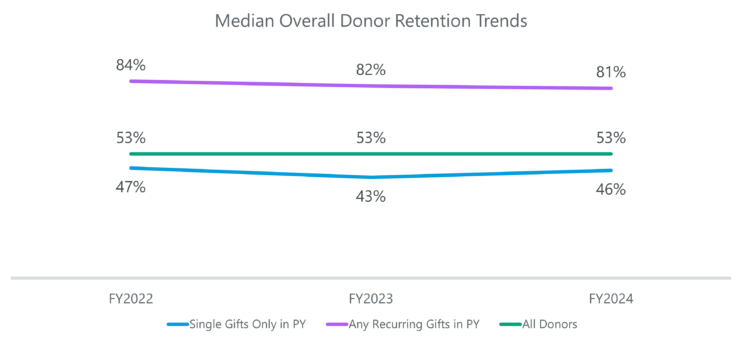

Sustainer Retention

Each year, donorCentrics analysis shows that donors who make recurring gifts retain at higher rates than single gift donors. In FY24, the overall retention rate for recurring gift donors was 81%, compared to 46% for single gift-only donors and 53% across all donors. The 13-month retention rate for new recurring donors was 47% in FY24, while first-year retention of donors acquired through single gifts was just 20%.

Comparing Long-Term Retention of Donors Acquired with Single vs. Recurring Gifts

The difference in long-term retention is clear when comparing donors acquired in FY22:

- 55% of donors acquired through recurring giving in FY22 were still giving in FY24.

- Only 15% of donors acquired with a single gift in FY22 were still giving in FY24.

The difference also extends to lifetime value per donor:

- $405: The lifetime value of a donor acquired through recurring giving in FY22 (as of FY24).

- $161: The lifetime value of a donor acquired with a single gift in FY22 (as of FY24).

The Enduring Impact of Recurring Giving

Sustainers showed stability in another year of single gift declines. The number of donors making recurring gifts remained steady with just a 1% change from FY23 to FY24, while single gift donors declined 11% over the same period. Sustainers continue to demonstrate their value year over year through higher retention rates and revenue per donor compared to single gifts.

As nonprofits navigate a shifting donor landscape, recurring giving remains a cornerstone of sustainable fundraising. This data reinforces the importance of investing in sustainer strategies that prioritize long-term value, retention, and donor engagement.

Catherine Ross from Blackbaud’s donorCentrics® team also contributed to this article.