The Lifecycle of a Nonprofit Budget: Keeping Your Mission at the Center

A budget is more than just a financial document.

It’s a reflection of your mission, vision, and goals. It helps you allocate your resources, measure your impact, and communicate your value to your stakeholders.

Creating a budget is not a one-time event. It has a dynamic lifecycle that involves constant monitoring, evaluation, and adjustment. Because it’s constantly evolving, you have to be intentional about keeping your organizational mission at the center.

In a recent webinar with Andrew Horrow and Seth Hopkins from Forvis Mazars, they talked through how to create a mission-focused budget for your nonprofit organization. They shared insights and best practices on how to plan, execute, and review your budget, while keeping your mission-driven strategy as the centripetal force.

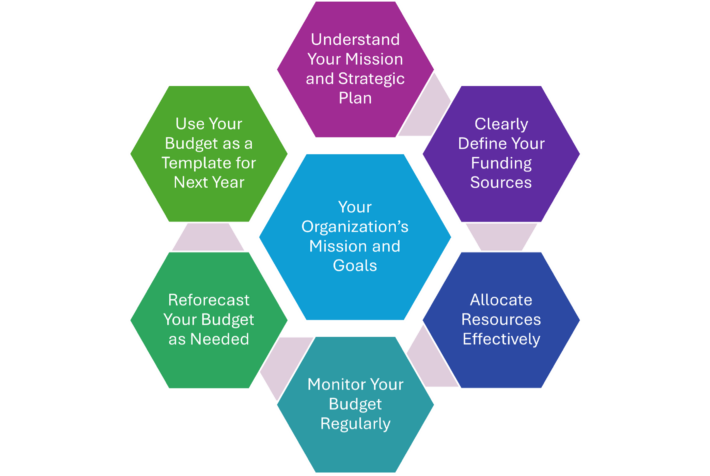

Based on their conversation, here are the six stages of a nonprofit budget lifecycle and how to make sure your mission stays central to each stage.

1. Understand Your Mission and Strategic Plan

You probably know your organization’s mission by heart, but it takes more than reciting it on demand to make sure it’s reflected in your strategy. Actively putting your mission at the center of your budget and strategic goals helps you better prioritize your spending and investments and align them with your outcomes.

Before you start putting any numbers into a spreadsheet, you need to decide which elements of your mission are most important to this budget cycle. Your mission is likely broad enough to encompass the general needs of your community within your impact area. Because of that, you have some flexibility as the needs of your community evolve. For example, if you focus on food insecurity for children, you might find that your work on access for the past few years has been successful. So this year, you want to shift some of your focus to encouraging parents of young families to build their confidence cooking healthy meals.

These conversations are likely happening as part of your nonprofit’s strategic planning, but make sure all parts of the organization understand their priorities based on the mission to make sure they are accurately accounted for in the budget.

Questions to ask in this stage of the nonprofit budget lifecycle:

- Are there elements of your mission that are more in-focus this year?

- How has your strategic plan changed from last year and why?

- How will these changes adjust your budget priorities?

2. Clearly Define Your Funding Sources

Define your funding sources and keep your mission in focus as you evaluate each one. You need to know where your money is coming from, how much you can expect, and whether the requirements and restrictions truly align with your mission.

Nonprofit organizations typically have a mix of funding sources, such as grants, donations, and program income. Each of these sources has its own advantages and disadvantages, and may require different levels of effort and resources to secure and manage.

For example, government grants may provide a large and stable source of funding, but they also come with strict reporting and compliance requirements. Fundraising events may generate a lot of enthusiasm and engagement, but they also involve significant marketing and outreach costs. Program and other earned income may help you diversify your revenue streams, but it also requires program support and quality assurance.

You need to be aware of the costs and benefits of each funding source, and how they align with your mission and goals. For example, a grant for your substance abuse clinic may cause mission creep if it requires you to start a new program on reskilling.

You also need to know the timeline and cycles for each funding source, and how they may affect your cash flow and spending patterns. Verify you have fundraising campaigns scheduled between program cycles, for example.

Questions to ask in this stage of the nonprofit budget lifecycle:

- Which of your funding sources require ancillary costs, such as reporting, marketing, or program support?

- How reliable and predictable are your funding sources?

- How do your funding sources match your mission and goals? Are there any that are causing mission creep?

3. Allocate Resources Effectively

You need to identify and rank the priorities of your expenses, and make sure they are aligned with your mission and overall strategy.

One of the trickiest parts of the expense side of your budget is your indirect costs, or administrative expenses. You need to know your indirect cost rate for each program as well as your organization, and make sure you are covering it adequately from your funding sources. Understand if you will be distributing your indirect costs by percentage of revenue or equally across all programs.

Remember that government grants will be raising the de minimus rate from 10 to 15% starting in October 2024, which means you can claim more indirect costs from your federal grants without having to provide a detailed breakdown.

Decide on a top-down allocation approach for your expenses so everyone understands your overall priorities. Start with your total revenue and expenses, and then distribute them among your programs and activities based on their alignment to your mission and goals.

Questions to ask in this stage of the nonprofit budget lifecycle:

- What are the key elements of your mission and goals that align most with your expenses?

- What is your indirect cost rate for each program and your organization?

- How are you recovering your indirect costs from your funding sources?

- What method are you using to allocate your resources among your programs and activities?

4. Monitor Your Budget Regularly

Regularly tracking your budget and comparing it with your actual performance helps you align your expectations and assumptions. It also allows you to adjust as the needs of your community change over the budget year.

During the webinar, attendees completed a poll asking how often they reviewed their budget. Of the 366 respondents, more than 50% said they reviewed their budget monthly. About 40% said they reviewed it quarterly or as needed, with 6% saying they only reviewed their budget during the annual budgeting process.

The more often you look at your Budget to Actuals report, the more you can get in front of any major changes, either in expenses or expectations. You can identify any variances, such as over- or under-spending, and analyze the reasons behind them. You can also spot any trends, patterns, or anomalies, and adjust your plans accordingly.

To monitor your budget effectively, you need to communicate with your program leaders and staff, and make sure they have access to the relevant financial information. You can use fund accounting software to create view-only access for your leadership and program managers, so they can check their budget status as needed. You can also use dashboards and graphs to visualize your financial data and make it easier to understand and share.

Remember, not everyone speaks “accounting,” so make sure the reports get to the points your leadership and program managers need to know in ways they understand.

Questions to ask in this stage of the nonprofit budget lifecycle:

- How often do you review your Budget to Actuals report?

- What are the main variances between your budget and your actual performance? Does this align with your mission?

- What are the causes and implications of these variances?

- How are you communicating your budget status and performance to your program leaders and staff?

5. Reforecast Your Budget as Needed

Reforecast your budget based on the changes and events that affect your organization and how you are serving your mission. Reforecasting allows you to update your budget projections and make any necessary adjustments to your revenue and expenses.

Reforecasting your budget is not the same as revising your budget. Revising your budget means changing your original budget plan, which may require approval from your board or funders. Reforecasting your budget means creating a new budget scenario based on the current situation, which helps you plan and manage your cash flow and spending. By reforecasting and finding potential issues, you might need to officially revise your budget.

To reforecast your budget effectively, you need to communicate with your leadership and board about what outside factors and unexpected events are affecting your budget. These could include things like changes in funding availability, shifts in community needs, or emergencies and crises. You need to establish regular reviews and adjust your assumptions based on these new events, such as a new grant or a need to add personnel because of increased demand.

You also need to run scenarios to provide direction based on potential outcomes. You can use fund accounting software to create different versions of your budget and compare them side by side. You can also use what-if analysis and sensitivity analysis to see how your budget would change if certain variables or assumptions changed.

Questions to ask in this stage of the nonprofit budget lifecycle:

- What external and internal factors are affecting your budget?

- How often are you reforecasting your budget based on these factors?

- What are the scenarios and assumptions that you are using to reforecast your budget?

- How are you presenting and explaining your reforecasted budget to your leadership and board? Are they terms and data points they care about?

6. Use Your Budget as a Template for Next Year

You don’t need to start from scratch each year. Use your budget as a template for next year. This is a great opportunity to review your budget performance and lessons learned and apply them to your future planning.

Using your budget as a template does not mean copying and pasting your numbers from one year to another. It means bringing over the parts that you need, such as line items, percentages, or actual expenses, and adjusting them based on your new goals and priorities. It also means learning from your mistakes and successes as well as improving your budget process and practices.

To use your budget as a template effectively, you need to evaluate your budget performance and identify what worked and what didn’t. Update your budget based on any changes to your mission focus and strategic plan. You can use fund accounting software to generate reports and metrics that show your financial results and impact. Solicit feedback from your program leaders and staff and incorporate their suggestions and ideas.

Questions to ask in this stage of the nonprofit budget lifecycle:

- What were the main achievements and challenges of your budget performance?

- What were the best practices and lessons learned from your budget process?

- How are you updating your budget based on your new mission and strategic plan?

- How are you using fund accounting software to create and manage your new budget?

Make Budgeting Simple with Fund Accounting Software

Creating and managing a nonprofit budget can be a complex and daunting task, but it doesn’t have to be. With the right tools and guidance, you can create a more effective and strategic budget for your organization and keep your mission at the center of your financial planning.

One of the tools that can help you simplify and streamline your budget process is fund accounting software. Fund accounting software is designed specifically for nonprofit organizations, and it allows you to track and report on your finances by fund, program, or project. It also helps you create and manage your budget, and monitor and reforecast it as needed.

If you want to learn more about how fund accounting software can help you create a better nonprofit budget, check out our webinar with Blackbaud University instructor Nate Hug on how Blackbaud Financial Edge NXT simplifies the budget creation process.