Understanding Contribution Revenue Recognition: What You Need to Know for FASB Compliance

A major donor just pledged a significant gift to fund a new science building at your college, and your development team is breaking out the champagne. But there’s a catch—the donor says they will only donate the money if your organization raises at least $200,000 to assist with the funding.

In the finance office, you know it’s not time to celebrate just yet. That’s because, to be GAAP compliant, the contribution revenue recognition guidelines outlined by Financial Accounting Standards Board (FASB) states that your team should only record the revenue from this gift once the donation is realized, not when it is pledged or even received.

In this article, we’ll cover how to identify and understand contribution revenue recognition specifically, with considerations for both donor restricted and unrestricted funds, to help you gain confidence and maintain compliance.

Contribution Revenue vs. Exchange Revenue

To accurately recognize revenue, you first need to understand the difference between contribution revenue and other types of revenue, such as exchange revenue. Contribution revenue is a non-reciprocal transaction where the donor doesn’t receive anything of value in return. Examples of contribution revenue include one-off donations from individuals, sustained giving, or grants.

This could also include a multi-year grant, which would be recognized over the program’s duration in a concept known as the matching principle. The revenue is tied to the program’s performance, even if the full grant amount was actually paid up front.

However, membership dues, service fees, and event revenue—like ticket sales—are considered exchange revenue, because the donor receives goods or services of a similar value in return for their contribution.

Why Contribution Revenue Recognition Matters for Nonprofits

Nonprofits rely on a multitude of income sources, and each of these transactions needs to be recorded accurately and on time. This means that your office must follow the generally accepted accounting principles (GAAP) developed and maintained by the Financial Accounting Standards Board (FASB), and stay on top of any changes to the rules.

Remaining compliant and transparent with financial records helps to build trust with funders and boost the credibility of your nonprofit. You demonstrate that your organization is in good health and their funds are being used to make a real impact. Sharing with donors how their gifts contributed to a recent successful fundraising event or helped provide more meals to those in need will go a long way toward continued support—and that all starts with clear reporting in the finance office.

In addition to compliance, accurate contribution revenue recognition enables your organization to assess financial health, allocate resources, plan for future programs, and ensure you are fulfilling your mission. To avoid unpleasant surprises down the road, the financial statements for your nonprofit should always align with both fundraising and finance’s expectations for a given quarter, so everyone knows exactly how much cash they actually have available for programs and expenses.

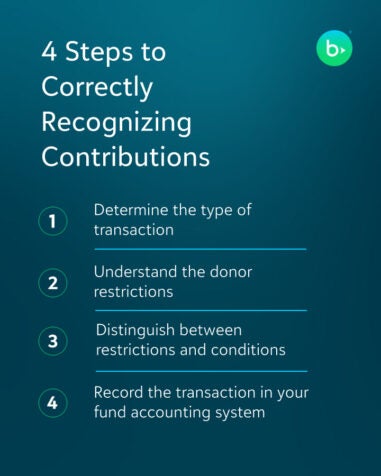

4 Steps to Correctly Recognizing Contributions

The following four steps will help you determine the type of transaction you’re dealing with, assess any conditions or restrictions, and accurately record the revenue.

Keep in mind that the main rule to follow when it comes to contribution revenue recognition is that unconditional contributions should be recognized immediately and classified as either net assets with donor restrictions or without donor restrictions.

Step 1: Determine the type of transaction

First, you must correctly categorize the transaction type as either contribution or exchange. If your nonprofit is selling tickets to a charity concert, for example, that would be an exchange transaction, and the revenue from ticket sales would be recognized after the concert is held.

But if an individual donates money to your mission, that is considered a contribution transaction. Now, you have to assess the specific conditions or restrictions of the donation.

Step 2: Understand donor restrictions

Nonprofits must also categorize contributions as either donor-restricted or donor-unrestricted based on the wishes that the donor stipulated. Did the donor specify what their donation could be used for or a specific time period for use, or was it simply a gift with no specific instructions?

FASB guidelines state that a major unrestricted donation should be recognized as revenue as soon as the donation is made, if there are no conditions.

If an individual donates to your nonprofit but stipulates that the funds must be used to fund scholarships, that is considered a restriction. While this won’t affect when revenue is recognized, it affects the classification of net assets.

Step 3: Distinguish between restrictions and conditions

There is a subtle but important distinction between restrictions and conditions when it comes to contribution revenue recognition. Restrictions stipulate how funds can be used, but they don’t impact when nonprofits recognize the revenue.

Conditions, however, can affect when revenue is recognized, because they dictate that the nonprofit must postpone recognition until they meet specific criteria. For example, a donation restricted to funding scholarships could still be immediately recognized as revenue if no conditions exist, but if there were conditions that also had to be met, like reaching a certain fundraising goal, then recognition would be delayed until those conditions are fulfilled.

Consider another example: A life insurance policy payout as part of a planned legacy gift. The funds can’t be recorded until after the donor dies, because they could change their will or designated beneficiaries at any time before that. After their passing, the condition is fulfilled, and the contribution can be recorded as revenue.

Step 4: Record the transaction

Now that you know the type of gift, its restrictions, and its conditions, it’s time to record the transaction. Make sure you keep a detailed record within your accounting software to ensure all FASB guidelines are followed and all conditions are fulfilled. You’ll also note if funds are restricted or unrestricted and separate them out in your records.

Practicing good document management and adding the gift agreement to the journal entry right away ensures that donor intent is always understood, no matter the time frame on revenue recognition. If your fundraising CRM and fund accounting system are integrated, this can be done automatically to streamline the entire process. This will also help to keep your fundraising and finance teams on the same page and cohesively sharing information.

Considerations for Donor Restricted and Unrestricted Funds

When it comes to separating restricted from unrestricted funds, an unrestricted donation with no conditions to fulfill will be recognized immediately as revenue, while a restricted donation will also be recognized immediately as revenue (assuming it is unconditional) but will be recorded and tracked separately.

Your Statement of Activities should clearly show unrestricted revenue, restricted revenue, and net assets. That way, you can see which funds can be used for various purposes and which are designated for specific expenses, helping you make smarter budgeting decisions and maintain trust and accountability with donors.

You also need to be able to do separate accounting entries and produce financial reports for your restricted funds. By implementing fund accounting software built for nonprofits, you will have unique records for each of your restricted funds. This means you can limit the spreadsheet juggling and manual work that you may be doing today.

Simplify Contribution Revenue Recognition with Fund Accounting Software

Fund accounting software built specifically for nonprofits can help streamline revenue tracking and ensure that you’re always on top of contribution revenue recognition. With a powerful solution like Blackbaud Financial Edge NXT®, you can save time, make more informed decisions, stay compliant, and be accountable to your valued donors.

Download the whitepaper, Unlock the Power of Fund Accounting for Stewardship, to learn five ways fund accounting software can boost donations and improve transparency at your nonprofit.